13.3.3 Two funds Lazy portfolios

- Information

- Lazy portfolios

- Prima pubblicazione: 05 Aprile 2022

«The shortest distance between two points is a straight line».

Archimede

Il Two funds portfolio è composto da 2 ETF ed è un portafoglio bilanciato: la percentuale di azionario e obbligazionario dipende dalla versione scelta .

Nella versione in USD, il Two funds è composto dai seguenti ETF:

- VTI: replica il mercato azionario statunitense (è un ETF di Vanguard dal TER eccezionalmente basso: 0,03%).

- BND: replica il mercato obbligazionario statunitense (anche questo è un ETF di Vanguard dal TER bassissimo: 0,035%).

Nella versione in EUR, abbiamo utilizzato i seguenti ETF (descrizione e caratteristiche):

| Descrizione degli ETF che compongono il Two funds portfolio | ||||

|---|---|---|---|---|

| Ticker | ISIN | Nome | Società emittente | Descrizione |

| CSEMU | IE00B53QG562 | iShares Core MSCI EMU UCITS ETF EUR (Acc) | iShares | Replica i titoli azionari ad alta e media capitalizzazione dei paesi dell'unione monetaria ed economica europea |

| EYLD | IE00BD49RB39 | WisdomTree EUR Aggregate Bond Enhanced Yield UCITS ETF EUR Acc | WisdomTree | Replica la performance di obbligazioni a tasso fisso, denominate in euro, includendo obbligazioni del tesoro, governative, societarie e cartolarizzate (Investment Grade) |

| Caratteristiche degli ETF che compongono il Two funds portfolio | |||||

|---|---|---|---|---|---|

| Ticker | TER | Replica | Hedging | PRO | CONTRO |

| CSEMU | 0.12% | Fisica (Replica totale) | No | Ampia diversificazione | Niente di rilevante |

| EYLD | 0.18% | Fisica (Campionamento) | No | Ampia diversificazione | Niente di rilevante |

Il two fund portfolio può avere diverse asset allocation: data la sua semplicità, basta alzare o abbassare la percentuale di uno dei due ETF per modularne la rischiosità.

I più conosciuti two fund portofolios americani sono i seguenti:

- Rick Ferri Two funds portfolio. È composto dal 40% di obbligazionario (US Bond market) e dal 60% di azionario (Total World market).

- John Bogle Two funds portfolio. Esistono 4 versioni: 20/80, 40/60, 60/40 e 80/20 (percentuali di obbligazionario e azionario). Bogle suggerisce la replica di obbligazioni a medio termine e del mercato azionario statunitensi.

- Warren Buffett Two funds portfolio. Questo portafoglio è uno di quelli che abbiamo analizzato e i suoi risultati verranno approfonditi nel capitolo 13.3.4.

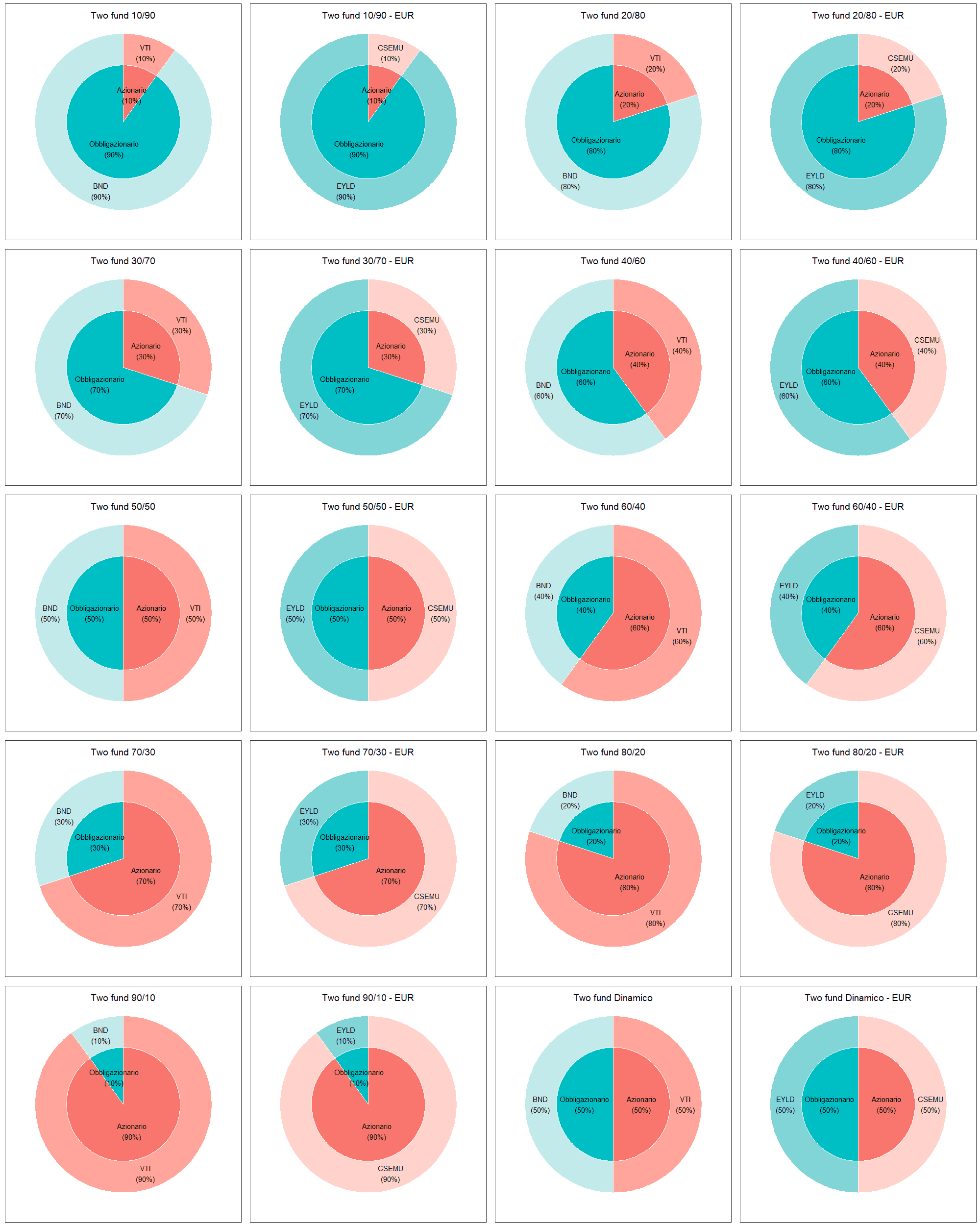

Asset allocation dei Two funds Lazy portfolios

Per verificare meglio il comportamento del Two funds portfolio, abbiamo deciso di backtestare tutte le possibili combinazioni di pesi tra i due ETF che lo compongono (con variazioni pari al ± 10%).

Gli ETF utilizzati nei backtest dei portafogli in EUR potrebbero essere sostituiti da quelli elencati nelle due tabelle seguenti (descrizione e caratteristiche degli ETF). Alcuni ETF che replicano lo stesso indice (o un indice simile) potrebbero essere stati esclusi.

| Gli ETF seguenti sono possibili alternative dell'ETF: CSEMU | ||||

|---|---|---|---|---|

| La lista è orientativa e non pretende di essere esaustiva | ||||

| Ticker | ISIN | Nome | Società emittente | Descrizione |

| ACWIE | IE00BYM11K57 | UBS ETF (IE) MSCI ACWI SF UCITS ETF (hedged to EUR) A-acc | UBS | Replica i titoli azionari di molti paesi sviluppati ed emergenti di tutto il mondo. La copertura valutaria in euro è relativa ai soli titoli dei paesi sviluppati |

| SWDA | IE00B4L5Y983 | iShares Core MSCI World UCITS ETF USD (Acc) | iShares | Replica i titoli azionari di circa 25 paesi sviluppati di tutto il mondo |

| VWCE | IE00BK5BQT80 | Vanguard FTSE All-World UCITS ETF (USD) Acc | Vanguard | Replica i titoli azionari dei paesi sviluppati ed emergenti di tutto il mondo |

| Ticker | TER | Replica | Hedging | PRO | CONTRO |

|---|---|---|---|---|---|

| ACWIE | 0.21% | Sintetica (Basata su swap) | Sì | - Amplissima diversificazione - Copertura valutaria e rischio di cambio limitato |

Replica sintetica |

| SWDA | 0.20% | Fisica (Campionamento ottimizzato) |

No | - Amplissima diversificazione, anche se inferiore agli ETF che replicano anche i titoli azionari dei paesi emergenti - Dimensione del fondo molto grande |

Rischio di cambio |

| VWCE | 0.22% | Fisica (Campionamento ottimizzato) |

No | Amplissima diversificazione | Rischio di cambio |

| Gli ETF seguenti sono possibili alternative dell'ETF: EYLD | ||||

|---|---|---|---|---|

| La lista è orientativa e non pretende di essere esaustiva | ||||

| Ticker | ISIN | Nome | Società emittente | Descrizione |

| AGGH | IE00BDBRDM35 | iShares Core Global Aggregate Bond UCITS ETF EUR Hedged (Acc) | iShares | Replica le obbligazioni emesse nei mercati emergenti e sviluppati di tutto il mondo (Investment Grade) |

| XG7S | LU0908508731 | Xtrackers Global Government Bond UCITS ETF 5C | DWS | Replica il mercato dei titoli di debito fisso emessi da governi di paesi sviluppati (Investment Grade) |

| XGSH | LU0378818131 | Xtrackers II Global Government Bond UCITS ETF 1C EUR Hedged | DWS | Replica il mercato mondiale delle obbligazioni governative emesse da nazioni sviluppate (Investment Grade) |

| Ticker | TER | Replica | Hedging | PRO | CONTRO |

|---|---|---|---|---|---|

| AGGH | 0.10% | Fisica (Campionamento) | Sì | - Amplissima diversificazione - Copertura valutaria e rischio di cambio molto limitato - TER basso |

Niente di rilevante |

| XG7S | 0.20% | Fisica (Campionamento) | No | Amplissima diversificazione | Rischio di cambio |

| XGSH | 0.25% | Fisica (Campionamento) | Sì | - Amplissima diversificazione - Copertura valutaria e rischio di cambio molto limitato |

Niente di rilevante |

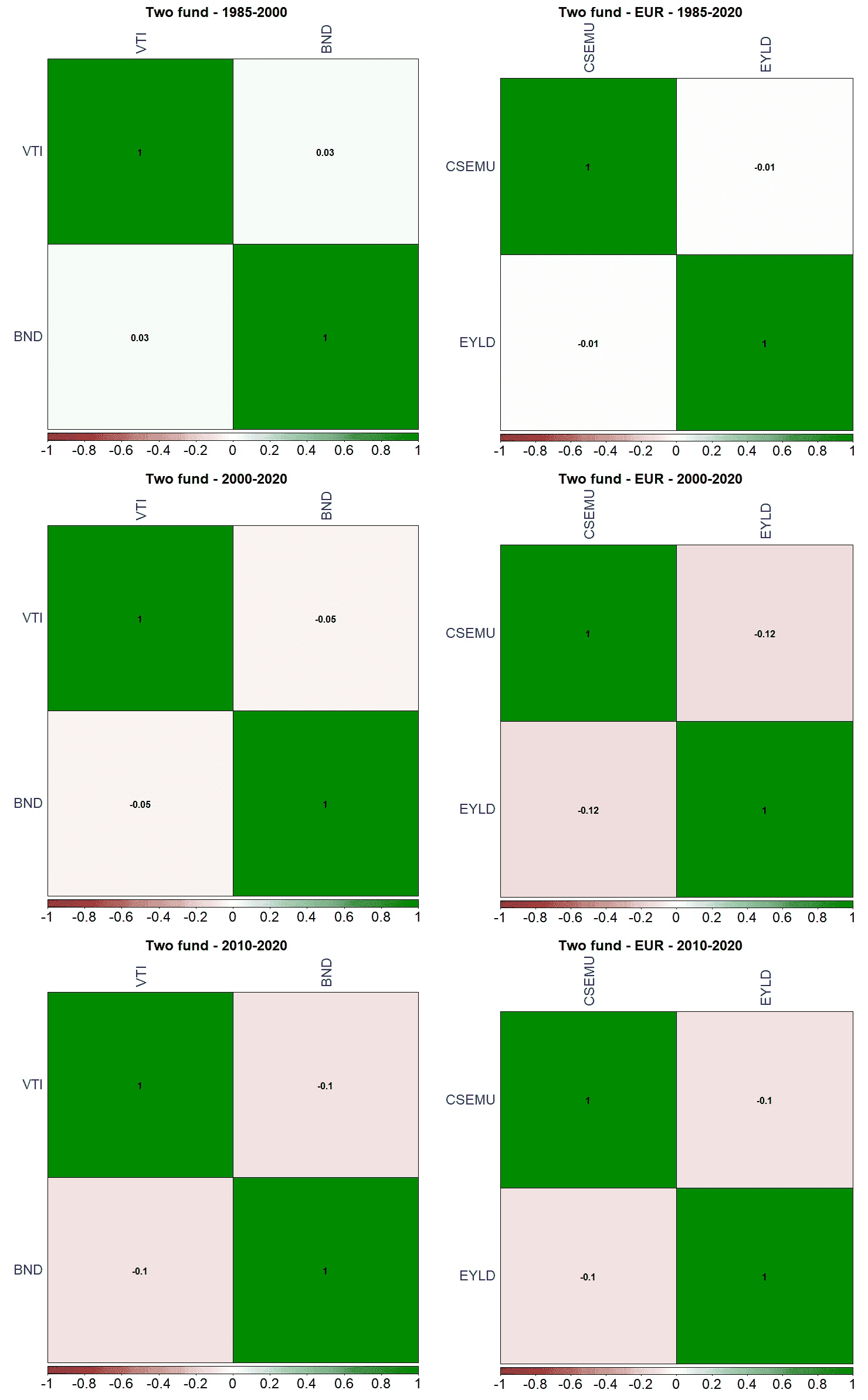

Qual è la correlazione lineare tra i rendimenti degli ETF che compongono il portafoglio?

Vediamola graficamente, sia per i portafogli in USD che per quelli in EUR e per tutte e 3 le durate analizzate:

Nel portafoglio in USD, la correlazione lineare tra gli ETF VTI e BND è 0,03, −0,05 e −0,10; in quello in EUR, la correlazione lineare tra gli ETF CSEMU e EYLD è −0,01, −0,12 e −0,10.

Il primo livello di diversificazione offerto dagli ETF che compongono il Two funds portfolio è ottimo.

Una nota a parte la merita il Two funds Lazy portfolio dinamico.

Nel Two funds dinamico il peso standard non è fisso, ma varia in base alla volatilità del mercato. Lo scopo è quello di garantire una maggiore conformità col contesto di mercato: cavalcare il trend azionario nelle fasi di crescita e viceversa.

L’indicatore utilizzato per la scelta del contesto di mercato è il VIX: esso misura la volatilità implicita dell’indice S&P 500 e permette di quantificare le aspettative del mercato sulla volatilità nei prossimi 30 giorni.

Senza entrare troppo nei dettagli, ci basta osservare che il VIX è inversamente correlato con lo S&P 500: se il VIX è alto, l’aspettativa è di una decrescita dello S&P 500 e viceversa.

Nei momenti di crisi più intensa dei mercati azionari, proprio durante le fasi di “panic selling”, il VIX raggiunge i suoi valori massimi.

Per questo motivo, il VIX è stato ribattezzato “indice della paura” (“the fear index”).

Nel Two funds dinamico, in fase di ottimizzazione dei pesi si può verificare uno dei seguenti scenari:

- Mercato azionario volatile (VIX > 24): il peso standard utilizzato è 10/90 (azionario = 10% e obbligazionario = 90%).

- Mercato azionario poco volatile (VIX ≤ 18): il peso standard utilizzato è 90/10 (azionario = 90% e obbligazionario = 10%).

- Mercato azionario mediamente volatile (18 < VIX ≤ 24): il peso standard utilizzato è 50/50 (azionario = 50% e obbligazionario = 50%).

Nei modelli vincolati, il peso standard selezionato in base al contesto di mercato potrà variare ulteriormente nel processo di ottimizzazione (± 5%).

I valori del VIX pari a 18 e 24 non sono il prodotto di un’artificiale calibrazione finalizzata a massimizzare la performance del Two funds portfolio dinamico in fase di backtest: sono valori che hanno una logica, ovviamente, ma che sono stati scelti prima di verificare i risultati dei backtest, eseguiti soltanto utilizzando queste soglie del VIX.

La stessa cosa può essere detta dei pesi scelti nei vari 3 scenari: perché 10-90, 50-50 o 90-10?

Queste tre opzioni non derivano da alcun processo di fine tuning applicato ai backtest: non c’è stato alcun Look-back bias.

L’unica motivazione è la logica associata alla creazione di un portafoglio aggressivo quando ci sono prospettive di una crescita dei mercati azionari, di un portafoglio prudente quando ci sono prospettive di una crisi finanziaria o di una decrescita dei mercati azionari e di un portafoglio equidistribuito tra componente azionaria e obbligazionaria quando ci si trova in una situazione di incertezza.

La scelta di pesi pari al 20-80/80-20 oppure 30-70/70-30 avrebbe potuto generare risultati molto diversi: dato che, in fin dei conti, si tratta di una scelta soggettiva, ognuno è libero di selezionare le soglie che ritiene più corrette.

La cosa da evitare è effettuare una scelta sulla base di multipli backtest eseguiti con lo scopo di verificare la combinazione che avrebbe massimizzato le performance passate: non c’è alcuna garanzia che essa produca risultati simili in futuro.

Equity lines, rendimenti e drawdown

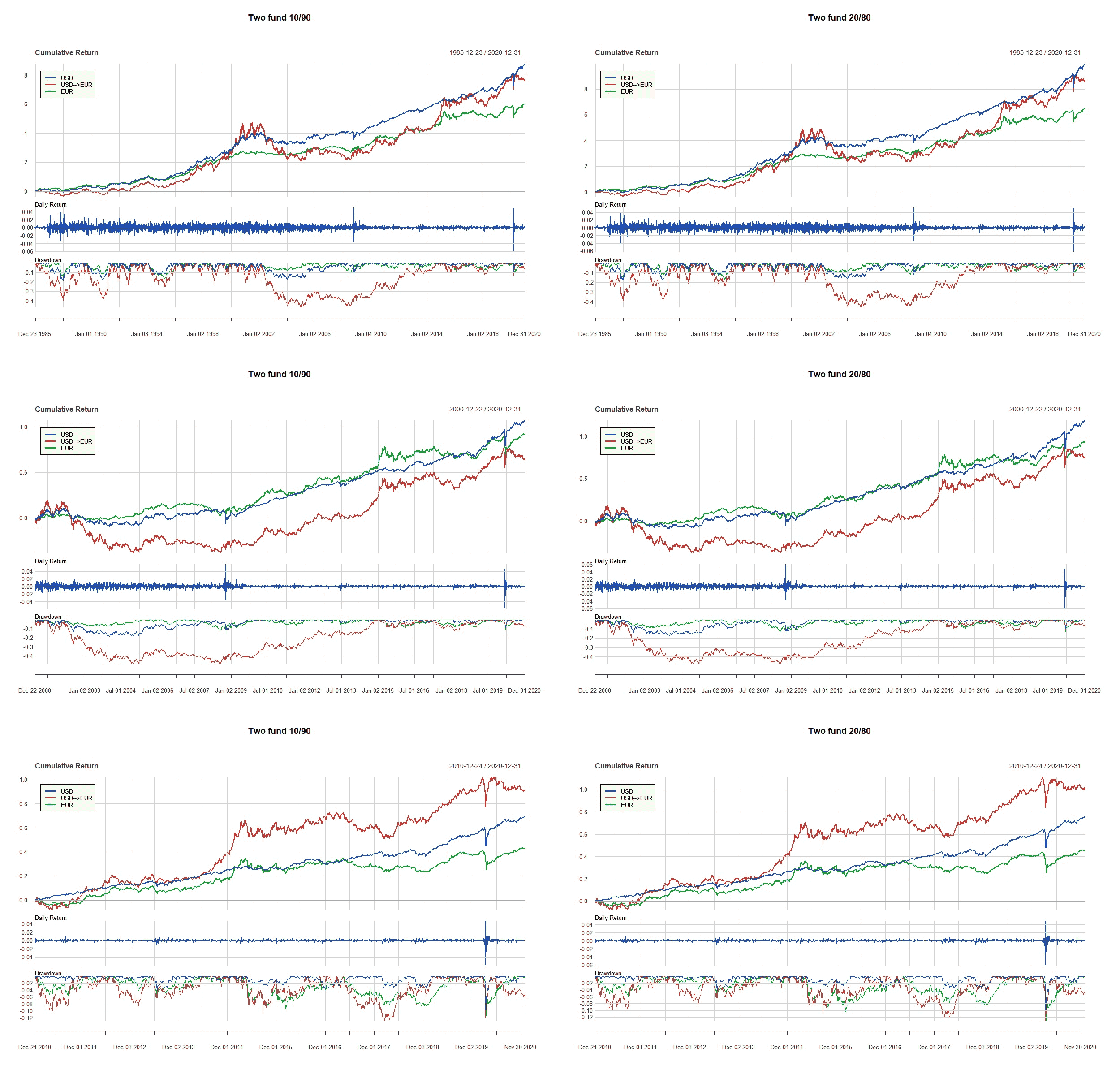

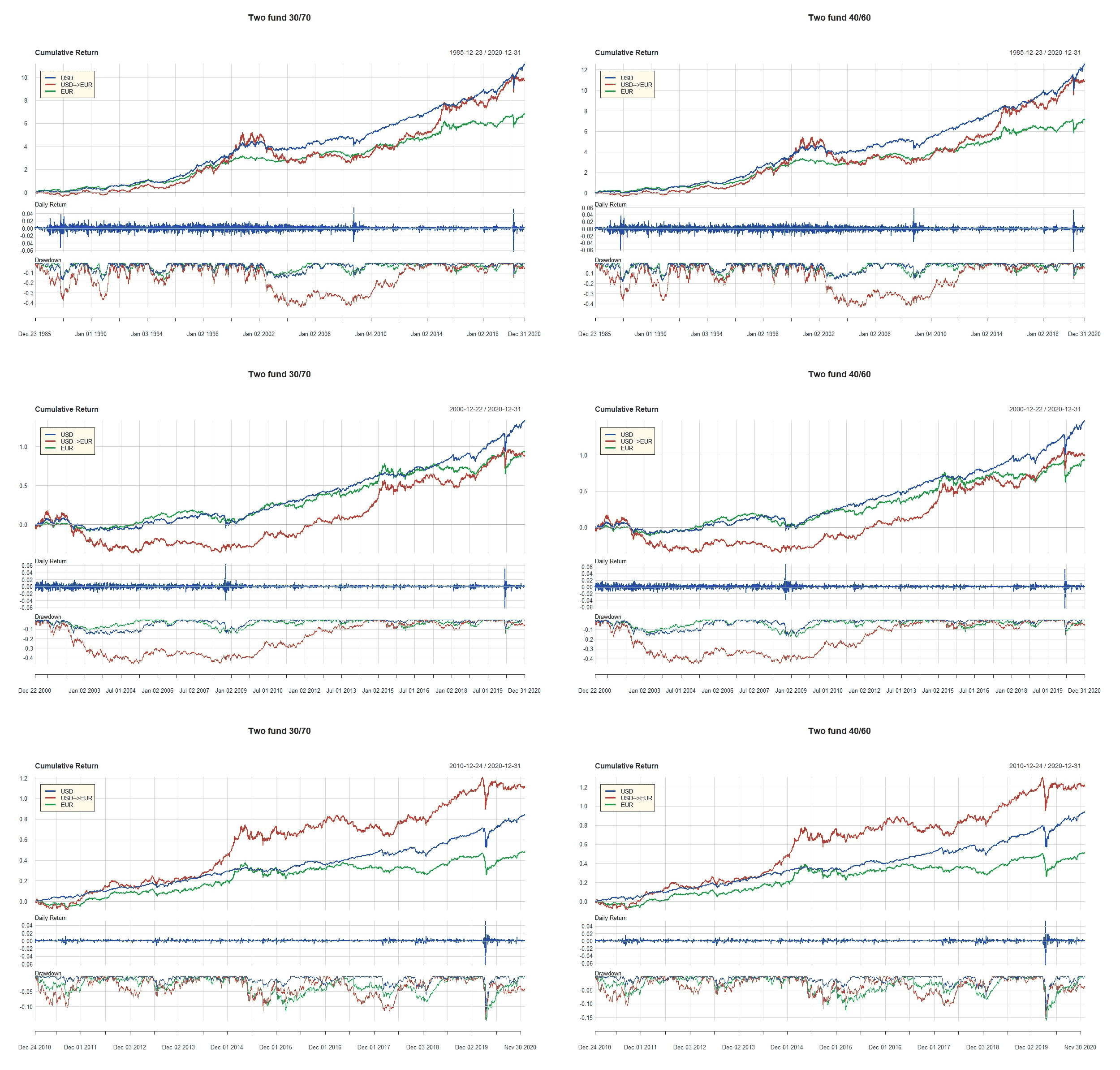

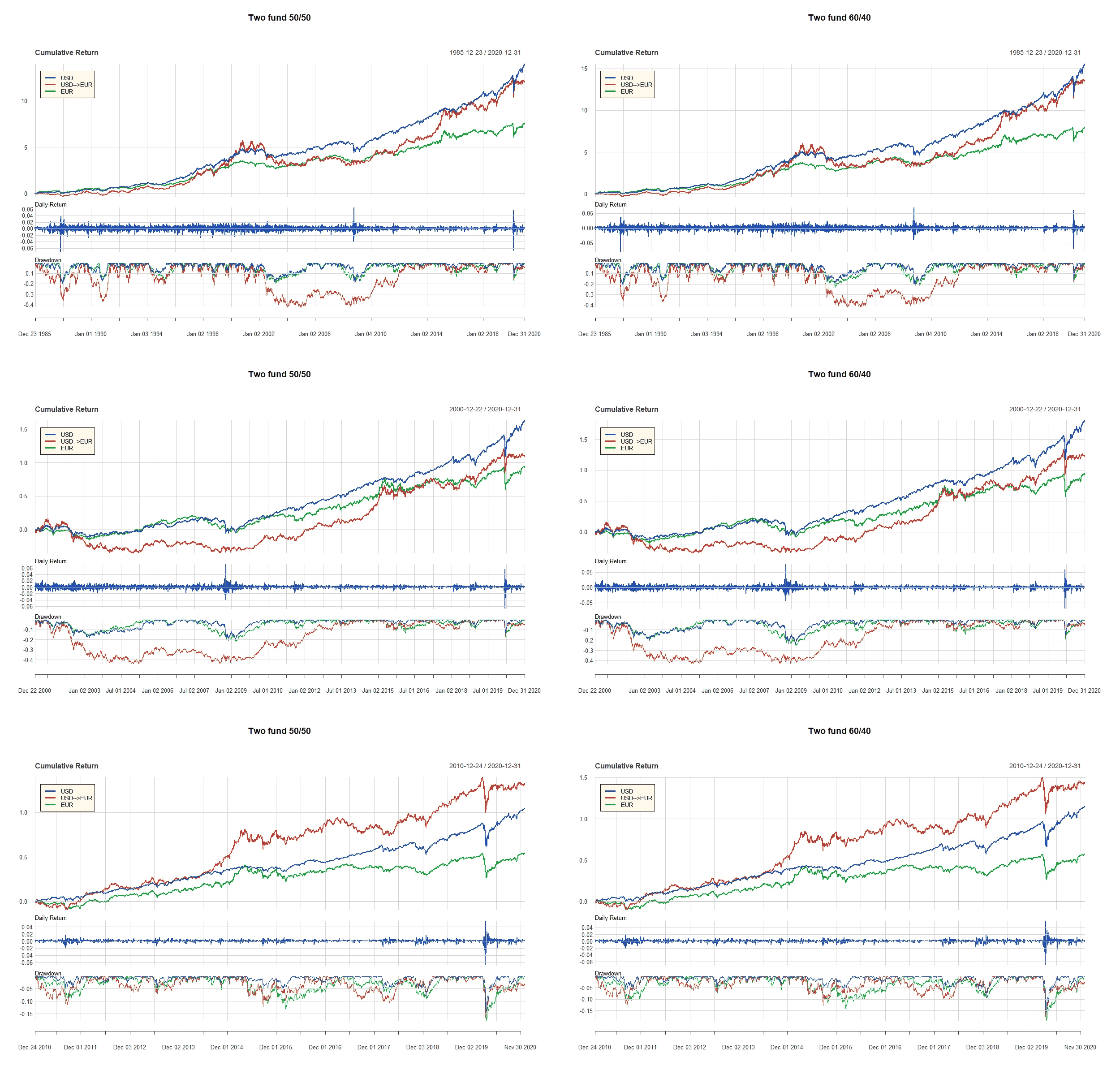

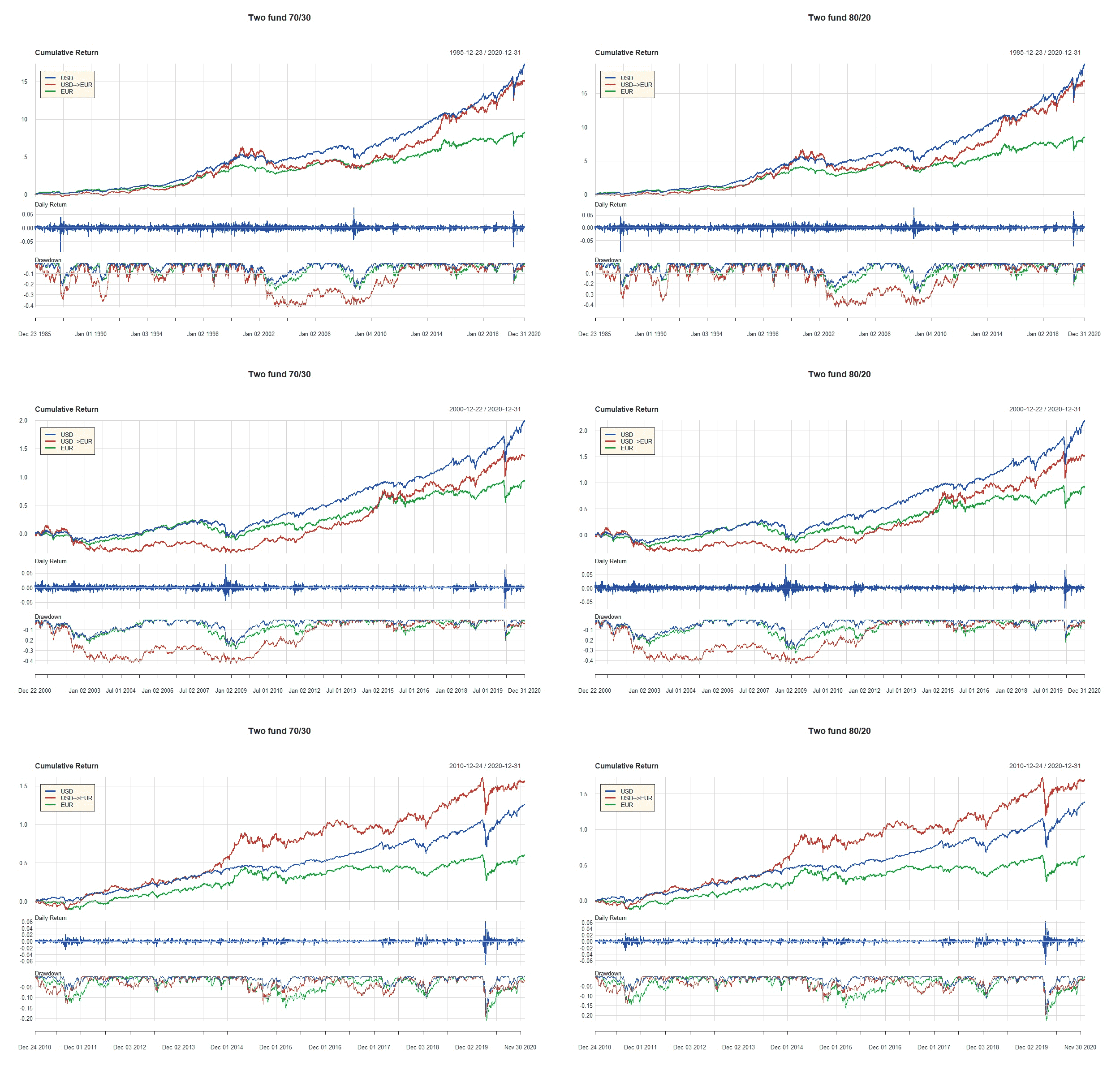

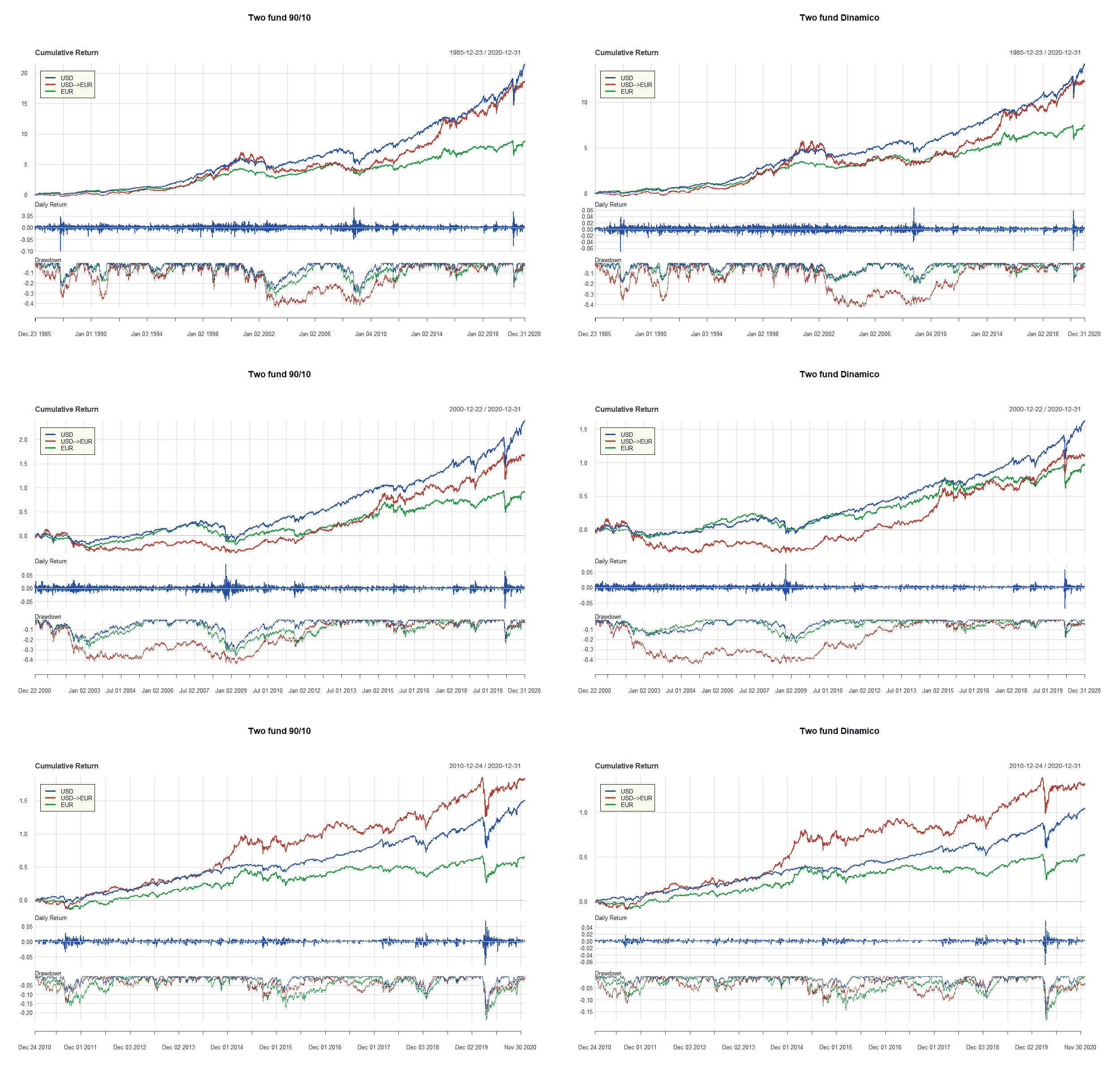

Come per i Lazy portfolios precedenti, mostreremo:

- Le equity lines ottenute dalle nostre analisi nei periodi 1985-2020, 2000-2020 e 2010-2020.

- I grafici dei rendimenti giornalieri.

- I grafici dei drawdown.

Per non riempire decine di pagine di grafici, li accorperemo in modo da farne entrare 6 in ogni pagina (ogni Two funds ha 3 grafici, uno per ognuno dei 3 periodi di analisi).

Seguiranno le nostre considerazioni.

Two funds 10/90 e 20/80

Two funds 30/70 e 40/60

Two funds 50/50 e 60/40

Two funds 70/30 e 80/20

Two funds 90/10 e dinamico

Two funds 90/10

Esaminiamo il Two funds 90/10 più attentamente.

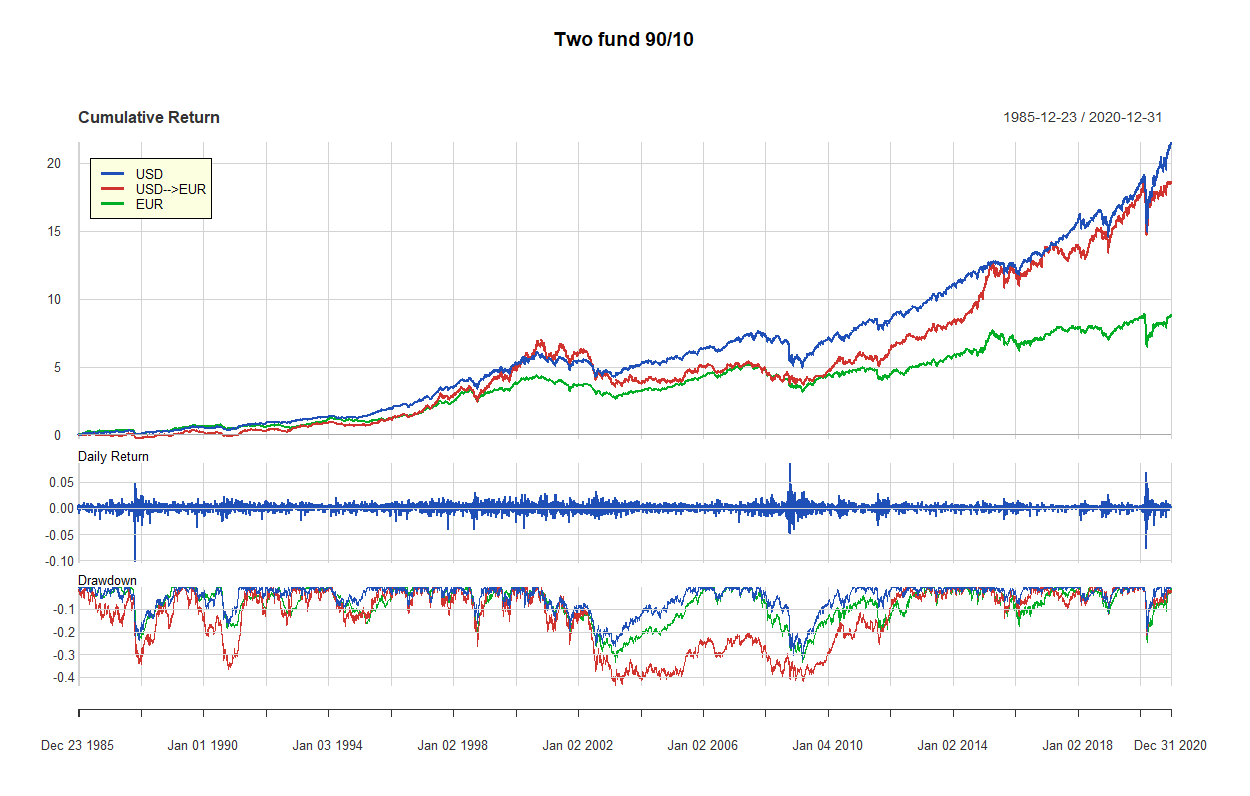

Vediamo il grafico delle equity lines che copre il periodo 1985-2020:

La parte superiore rappresenta l’equity line del Two Fund 90/10 in USD, USD→EUR e EUR (medie degli 11 modelli di ottimizzazione backtestati).

La parte centrale del grafico misura il rendimento giornaliero del Two Fund 90/10 in USD. Il rendimento medio del Two Fund 90/10 in USD è stato 0,0368% e la deviazione standard dei rendimenti giornalieri è stata 0,6882%.

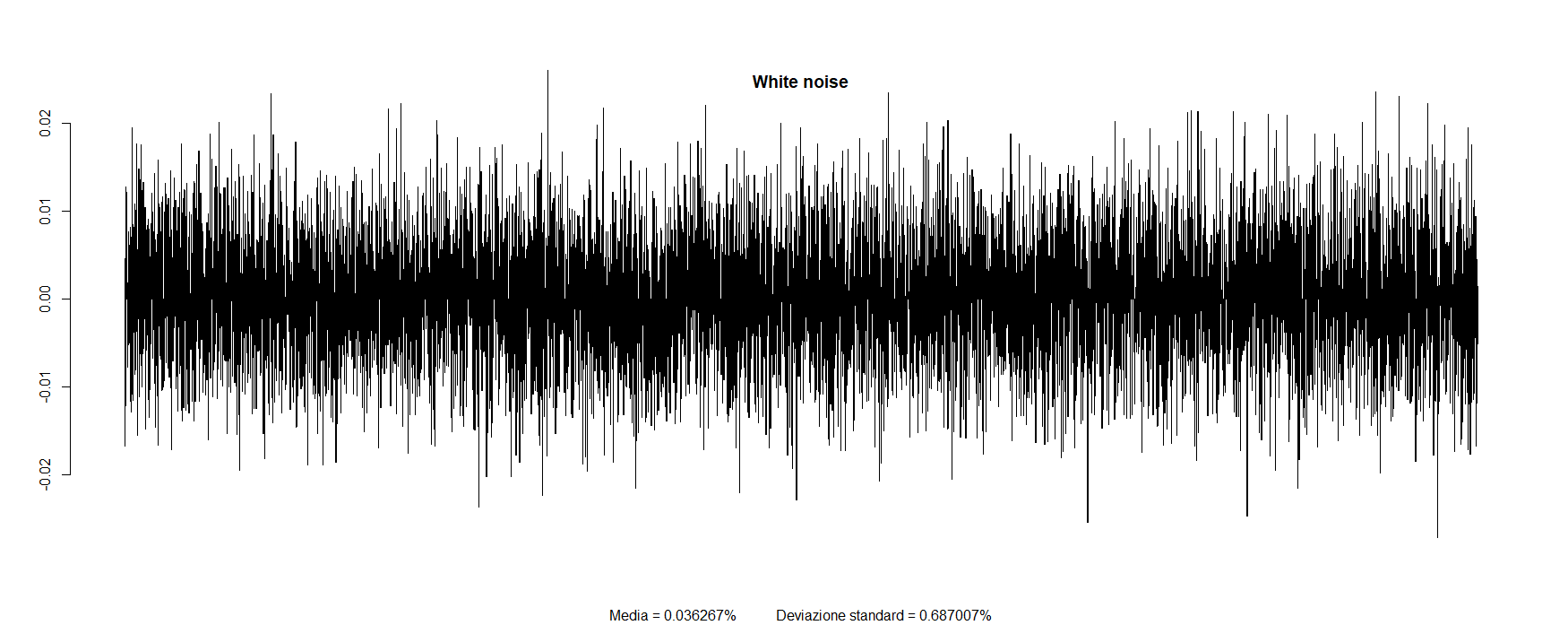

Vediamo di quanto si discosta la conformazione del grafico a barre dei rendimenti giornalieri da quella di un white noise.

Il grafico sottostante rappresenta un white noise generato in modo che abbia una media approssimativamente pari a 0, 0368% e una deviazione standard dell’0,6882%:

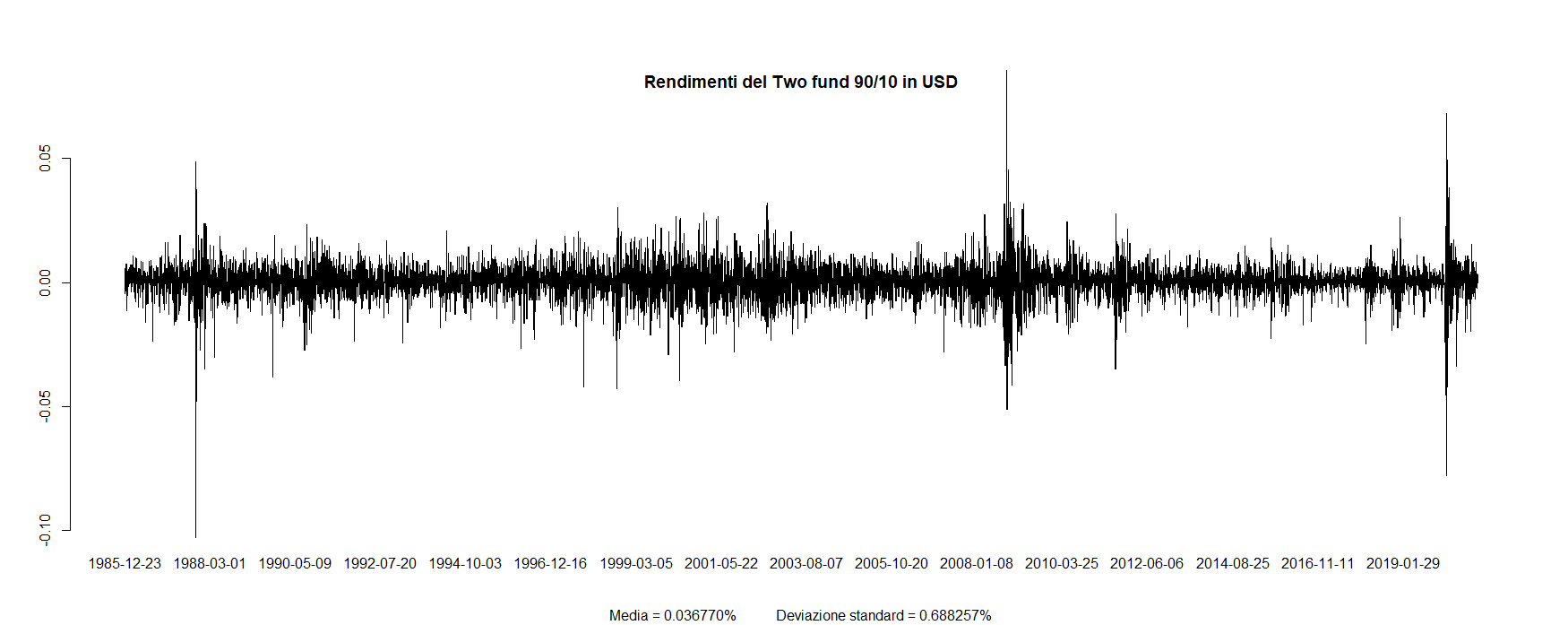

Il grafico a barre dei rendimenti del World Stocks in USD è il seguente:

Non proprio un white noise. Sono visibili in maniera chiara i picchi di volatilità del Black Monday del 1987, della crisi dei subprime del 2008/2009 e di quella del COVID-19 del 2020.

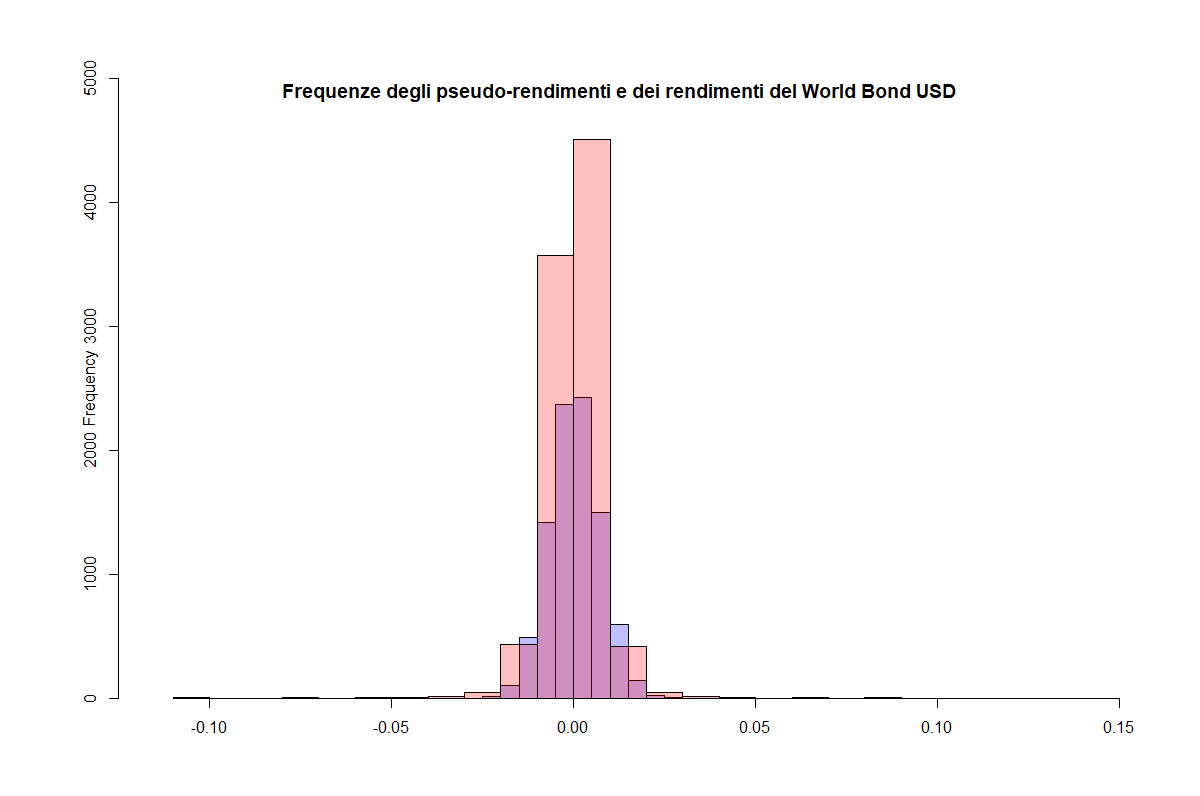

Vediamo le distribuzioni degli pseudo-rendimenti white noise e quelli del Two funds 90/10 in USD:

Come ci aspettavamo, la distribuzione con le frequenze più vicine a 0 e con le code più spesse è quella dei rendimenti del Two funds 90/10 in USD; l’altra è quella degli pseudo-rendimenti white noise che, come ormai sappiamo, sono distribuiti normalmente.

Il grafico situato nella parte inferiore raffigura l’andamento del drawdown: diminuzioni di rendimento calcolate dai livelli massimi di rendimento cumulato della equity line.

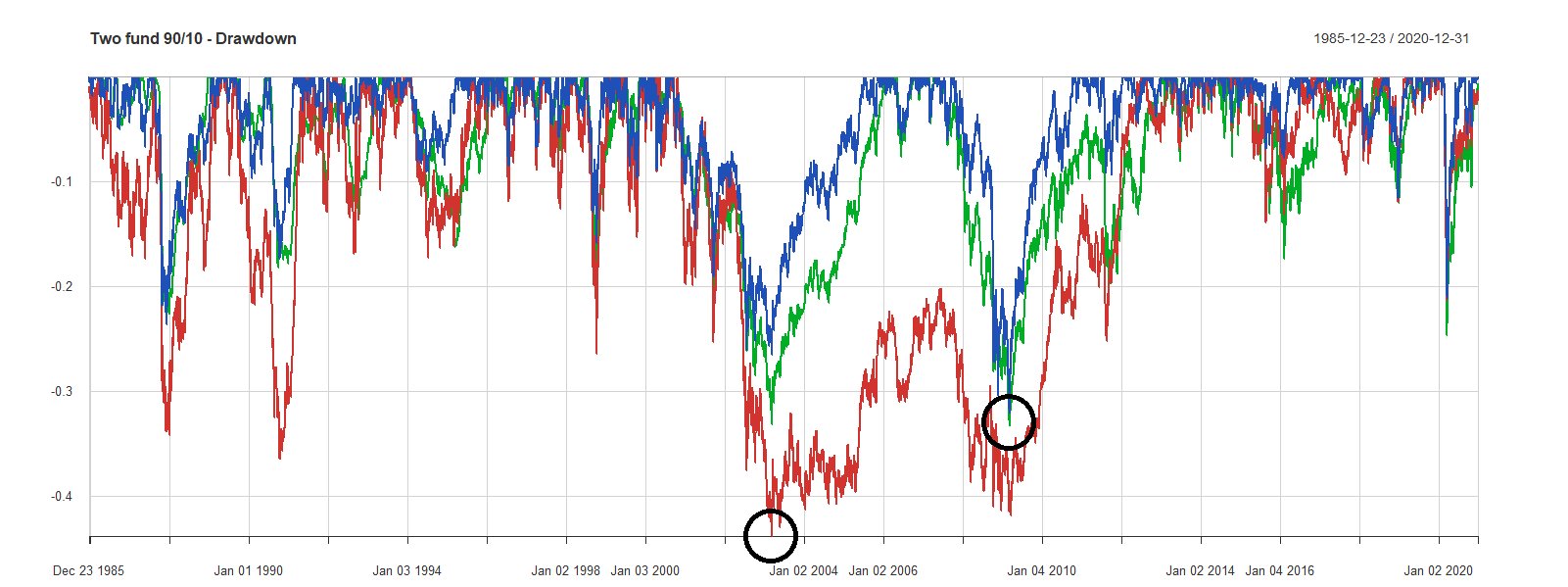

Lo visualizziamo di nuovo:

I massimi drawdown del Two funds 90/10 sono stati contrassegnati dai cerchietti neri:

- In USD, il massimo drawdown è stato del 32,11%.

- In EUR, il massimo drawdown è stato del 33,34%.

- In USD→EUR, il massimo drawdown è stato del 43,84%.

Stavolta, i drawdown del portafoglio in EUR non sono molto più ampi di quelli del portafoglio in USD, come era avvenuto per il World Stocks.

Nel Two funds in USD gli ETF utilizzati – un azionario e un obbligazionario – replicano il mercato statunitense. In quello in EUR, replicano il mercato dell’area euro.

Questo è il motivo per cui i risultati del World Stocks (100% azionario) e del Two funds 90/10 (90% azionario) sono così diversi, al di là di quel 10% in più di componente azionaria del World Stocks: tutte le tipologie di Two funds analizzate azzerano il rischio di cambio.

Le misure di rischio calcolate per questi portafogli quantificano soltanto il rischio di mercato.

I drawdown del Two funds 90/10 in USD→EUR sono invece decisamente superiori. Oltre al rischio di mercato, l’investitore dell’area euro che avesse scelto questo portafoglio si sarebbe assunto anche una grossa porzione di rischio di cambio.

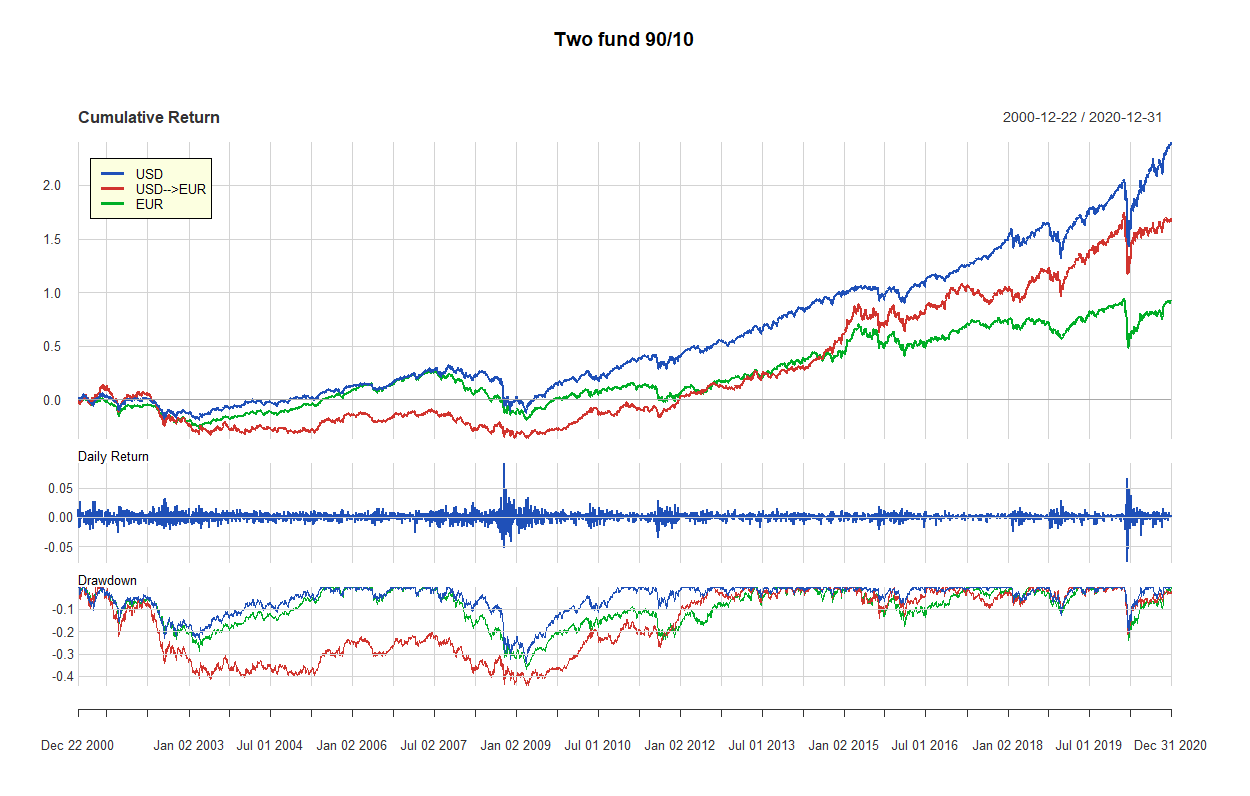

Vediamo il grafico relativo al periodo 2000-2020:

L’andamento non è molto diverso da quello del periodo più lungo: le considerazioni fatte in precedenza sono valide anche per il periodo 2000-2020.

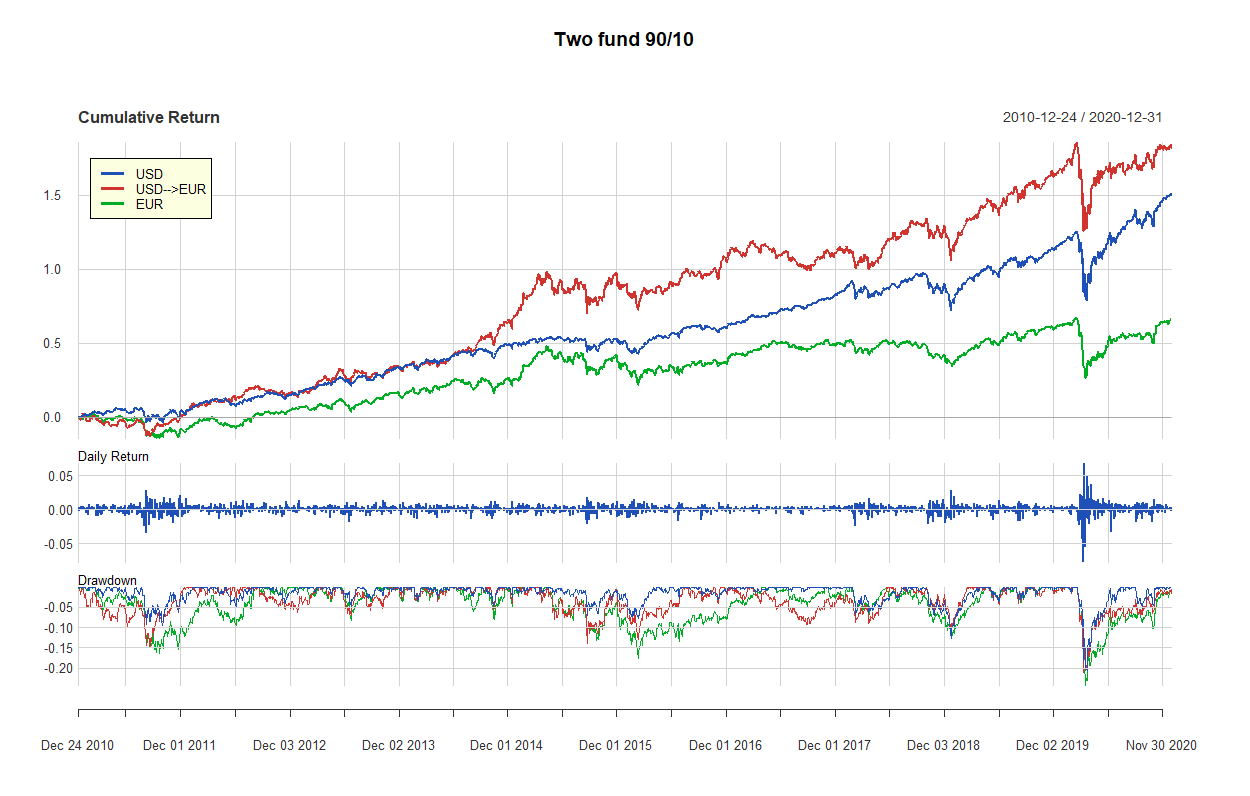

Vediamo infine il grafico del periodo 2010-2020:

Nel decennio 2010-2020, il rischio di cambio avrebbe favorito l’investitore dell’area euro.

Un ultimo commento sul Two funds dinamico: i suoi risultati sono molti simili a quelli del Two funds 50/50. Questo significa che l’asset allocation utilizzata è stata il 50% azionario e il 50% obbligazionario per quasi tutto il periodo di analisi.

Probabilmente la scelta del livello del VIX pari a 24 non è stata ottimale e non ha creato quella dinamicità nell’asset allocation che ci aspettavamo.

La reazione automatica – ma sbagliata – sarebbe quella di abbassare la soglia VIX da 24 a 20, 18 o a un valore ancora inferiore e verificare i cambiamenti che si sarebbero prodotti nei risultati dei backtest, fino a trovare quelli che avrebbero reso i risultati ottenuti attraenti per un investitore.

Non è quello che faremo. Come abbiamo più volte ripetuto in questo stesso capitolo e nei capitoli 7 e 9, non ci interessa ottimizzare il valore del VIX sui dati passati per poter presentare un Lazy portfolio di nostra creazione che abbia sovraperformato tutti gli altri Two funds.

Sarebbe un esercizio inutile, perché quelle performance sarebbero dovute a un overfitting del VIX e il Two funds dinamico così costruito non avrebbe modo di ripetere quei risultati in futuro.

Avremmo però fatto un figurone e, forse, proprio i bei risultati di quel Two funds dinamico ci avrebbero permesso di ottenere molte sottoscrizioni in più al nostro sito.

È quello che consciamente o inconsciamente fanno la stragrande maggioranza dei fornitori o venditori di trading system.

È, nella stragrande maggioranza dei casi, anche ciò che fanno i trader, gli analisti tecnici o gli analisti fondamentali.

È, probabilmente, quello che fanno alcuni gestori attivi nel management dei loro stessi fondi, credendo di fare la cosa giusta mentre stanno in realtà spalancando le porte all’inevitabile disastro o, nella migliore delle ipotesi, a una gestione che nel lungo termine non farà altro che sottoperformare sempre di più il benchmark che avrebbe l’obiettivo di battere.

Arrivati a questo punto, cosa dovremmo fare con il nostro Two funds dinamico?

Ripartire con l’analisi da zero. Il VIX dovrebbe essere abbandonato.

Le azioni da seguire dovrebbero più o meno essere le seguenti:

- Pensare a qualcosa di nuovo; ipotizzare una diversa variabile connessa ai mercati replicati dagli ETF del Two funds Lazy portfolio, che abbia con essi una qualche relazione economico-statistica: un possibile nesso di causalità che sia sfruttabile (la semplice correlazione lineare non basta e non garantisce niente).

- Una volta trovata, dovremmo modificare l’algoritmo scritto in linguaggio R – il motore delle nostre analisi – per renderlo compatibile con la nuova ipotesi.

- Effettuare un nuovo backtest e analizzare i risultati ottenuti per valutare se il Two funds dinamico ribilanciato secondo il nuovo algoritmo abbia o meno delle chance di successo.

Non è facile e non è come la maggior parte degli analisti risponde agli insuccessi: il comportamento corretto è controintuitivo.

Performance del Two Fund

Presentiamo qui di seguito tutti i risultati dei backtest, suddivisi per modelli statici, dinamici vincolati e dinamici non vincolati (l’ordine seguito sarà Two funds portfolio 10-90, Two funds portfolio 20-80, …, Two funds portfolio 90-10 e Two funds portfolio dinamico).

Two funds 10/90

| Two funds 10/90: Modelli dinamici vincolati e modello statico standard | ||||||

|---|---|---|---|---|---|---|

| Performance delle 12 misure statistiche calcolate sulla base di ciascun modello di ottimizzazione | ||||||

| Misura statistica | Modello Statico | Modelli dinamici vincolati | ||||

| Standard | Boudt SD ROI | Boudt SD Random | Boudt CVaR ROI | TCOV ROB | Naif | |

| USD 1985-2020 | ||||||

| Return | 5.68% | 5.69% | 5.63% | 5.83% | 5.72% | 5.69% |

| Standard Deviation | 8.14% | 7.93% | 7.91% | 7.96% | 7.93% | 7.93% |

| Sharpe Ratio | 0.6973 | 0.7182 | 0.7120 | 0.7319 | 0.7205 | 0.7176 |

| Cumulative Return | 628.76% | 632.87% | 616.97% | 667.22% | 638.20% | 631.00% |

| Worst Drawdown | 22.63% | 20.79% | 20.85% | 21.10% | 20.81% | 20.85% |

| Average Drawdown | 1.11% | 1.02% | 1.04% | 1.00% | 1.02% | 1.02% |

| Average Length | 24.2849 | 22.2182 | 22.9811 | 21.5646 | 22.2943 | 22.2260 |

| Average Recovery | 12.8148 | 11.5325 | 12.0566 | 11.0861 | 11.6745 | 11.5818 |

| Hurst Index | 0.3321 | 0.3385 | 0.3384 | 0.3367 | 0.3387 | 0.3383 |

| VaR | −0.73% | −0.70% | −0.70% | −0.71% | −0.70% | −0.70% |

| CVaR | −1.00% | −0.92% | −0.91% | −1.00% | −0.93% | −0.92% |

| Sortino Ratio | 1.0494 | 1.0774 | 1.0690 | 1.0955 | 1.0802 | 1.0764 |

| USD 2000-2020 | ||||||

| Return | 3.16% | 3.20% | 3.14% | 3.22% | 3.28% | 3.19% |

| Standard Deviation | 6.09% | 5.94% | 5.92% | 6.10% | 5.98% | 5.93% |

| Sharpe Ratio | 0.5196 | 0.5388 | 0.5296 | 0.5274 | 0.5485 | 0.5367 |

| Cumulative Return | 89.48% | 90.72% | 88.45% | 91.55% | 93.76% | 90.25% |

| Worst Drawdown | 22.35% | 20.89% | 20.81% | 22.47% | 21.29% | 21.00% |

| Average Drawdown | 0.63% | 0.60% | 0.63% | 0.64% | 0.59% | 0.61% |

| Average Length | 22.4037 | 21.2087 | 22.5787 | 22.6111 | 20.3473 | 21.6756 |

| Average Recovery | 13.6422 | 12.5522 | 13.5000 | 13.6250 | 12.1004 | 12.8756 |

| Hurst Index | 0.3875 | 0.3908 | 0.3909 | 0.3905 | 0.3914 | 0.3908 |

| VaR | −0.48% | −0.45% | −0.45% | −0.46% | −0.45% | −0.45% |

| CVaR | −0.48% | −0.45% | −0.45% | −0.46% | −0.45% | −0.45% |

| Sortino Ratio | 0.7616 | 0.7893 | 0.7763 | 0.7731 | 0.8018 | 0.7865 |

| USD 2010-2020 | ||||||

| Return | 4.76% | 4.80% | 4.70% | 4.88% | 4.85% | 4.79% |

| Standard Deviation | 4.00% | 4.02% | 3.96% | 4.07% | 4.03% | 4.01% |

| Sharpe Ratio | 1.1895 | 1.1938 | 1.1862 | 1.1987 | 1.2014 | 1.1925 |

| Cumulative Return | 61.16% | 61.79% | 60.19% | 63.14% | 62.57% | 61.60% |

| Worst Drawdown | 9.51% | 9.43% | 9.29% | 9.50% | 9.37% | 9.42% |

| Average Drawdown | 0.41% | 0.40% | 0.41% | 0.40% | 0.39% | 0.40% |

| Average Length | 12.9722 | 11.9538 | 12.7486 | 11.5594 | 11.7085 | 12.1458 |

| Average Recovery | 7.5833 | 6.6769 | 7.3443 | 6.3366 | 6.3417 | 6.8281 |

| Hurst Index | 0.4745 | 0.4732 | 0.4729 | 0.4719 | 0.4718 | 0.4732 |

| VaR | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| CVaR | −0.66% | −0.66% | −0.66% | −0.66% | −0.66% | −0.66% |

| Sortino Ratio | 1.6128 | 1.6195 | 1.6076 | 1.6305 | 1.6333 | 1.6176 |

| USD → EUR 1985-2020 | ||||||

| Return | 4.67% | 4.80% | 4.79% | 4.96% | 4.75% | 4.75% |

| Standard Deviation | 15.46% | 15.18% | 15.18% | 15.22% | 15.14% | 15.14% |

| Sharpe Ratio | 0.3020 | 0.3160 | 0.3157 | 0.3257 | 0.3135 | 0.3136 |

| Cumulative Return | 416.39% | 439.65% | 438.49% | 470.04% | 429.95% | 430.03% |

| Worst Drawdown | 51.95% | 52.04% | 51.80% | 50.40% | 51.52% | 51.48% |

| Average Drawdown | 4.01% | 3.96% | 3.98% | 3.76% | 3.87% | 3.86% |

| Average Length | 67.6439 | 68.5846 | 68.0611 | 63.6714 | 66.5746 | 66.0889 |

| Average Recovery | 32.7424 | 34.2385 | 32.6794 | 31.6857 | 33.3507 | 32.8296 |

| Hurst Index | 0.2706 | 0.2717 | 0.2712 | 0.2750 | 0.2720 | 0.2721 |

| VaR | −1.48% | −1.45% | −1.45% | −1.46% | −1.45% | −1.45% |

| CVaR | −2.11% | −2.08% | −2.08% | −2.10% | −2.07% | −2.07% |

| Sortino Ratio | 0.5403 | 0.5576 | 0.5570 | 0.5710 | 0.5536 | 0.5537 |

| USD → EUR 2000-2020 | ||||||

| Return | 1.73% | 1.65% | 1.73% | 1.86% | 1.68% | 1.68% |

| Standard Deviation | 12.23% | 12.06% | 12.05% | 12.16% | 12.02% | 12.02% |

| Sharpe Ratio | 0.1416 | 0.1372 | 0.1437 | 0.1533 | 0.1398 | 0.1399 |

| Cumulative Return | 42.21% | 40.01% | 42.23% | 46.07% | 40.77% | 40.76% |

| Worst Drawdown | 51.74% | 51.90% | 51.35% | 51.39% | 52.01% | 51.55% |

| Average Drawdown | 3.05% | 3.04% | 2.92% | 2.95% | 3.02% | 2.96% |

| Average Length | 93.2727 | 93.2909 | 90.0351 | 90.0000 | 93.2545 | 89.9825 |

| Average Recovery | 45.6727 | 45.9091 | 44.0526 | 43.9123 | 45.7455 | 43.9123 |

| Hurst Index | 0.3053 | 0.3042 | 0.3040 | 0.3061 | 0.3066 | 0.3055 |

| VaR | −1.22% | −1.20% | −1.20% | −1.21% | −1.20% | −1.20% |

| CVaR | −1.82% | −1.80% | −1.80% | −1.83% | −1.80% | −1.79% |

| Sortino Ratio | 0.2871 | 0.2794 | 0.2885 | 0.3025 | 0.2827 | 0.2828 |

| USD → EUR 2010-2020 | ||||||

| Return | 5.49% | 5.39% | 5.38% | 5.54% | 5.53% | 5.48% |

| Standard Deviation | 8.82% | 8.60% | 8.60% | 8.75% | 8.62% | 8.61% |

| Sharpe Ratio | 0.6218 | 0.6262 | 0.6260 | 0.6338 | 0.6411 | 0.6366 |

| Cumulative Return | 73.03% | 71.37% | 71.26% | 74.01% | 73.73% | 72.95% |

| Worst Drawdown | 13.73% | 14.42% | 14.48% | 13.87% | 13.80% | 13.80% |

| Average Drawdown | 1.83% | 1.72% | 1.76% | 1.70% | 1.67% | 1.71% |

| Average Length | 34.8889 | 33.5333 | 34.4247 | 32.6753 | 32.6234 | 33.4800 |

| Average Recovery | 19.9028 | 18.8133 | 19.2877 | 18.4156 | 18.2597 | 18.7733 |

| Hurst Index | 0.3742 | 0.3734 | 0.3738 | 0.3700 | 0.3731 | 0.3737 |

| VaR | −0.80% | −0.78% | −0.78% | −0.81% | −0.78% | −0.78% |

| CVaR | −1.19% | −1.16% | −1.16% | −1.24% | −1.17% | −1.16% |

| Sortino Ratio | 0.9497 | 0.9551 | 0.9547 | 0.9655 | 0.9759 | 0.9692 |

| EUR 1985-2020 | ||||||

| Return | 5.01% | 5.03% | 5.05% | 5.10% | 5.04% | 5.06% |

| Standard Deviation | 4.94% | 4.84% | 4.79% | 4.95% | 4.87% | 4.83% |

| Sharpe Ratio | 1.0137 | 1.0388 | 1.0536 | 1.0286 | 1.0343 | 1.0474 |

| Cumulative Return | 480.40% | 484.24% | 487.79% | 497.32% | 485.55% | 489.91% |

| Worst Drawdown | 18.55% | 18.23% | 18.23% | 18.26% | 18.26% | 18.26% |

| Average Drawdown | 0.99% | 0.98% | 0.97% | 1.02% | 1.00% | 0.98% |

| Average Length | 28.9865 | 28.4884 | 28.3543 | 29.0949 | 28.2970 | 28.0000 |

| Average Recovery | 13.9122 | 14.4186 | 14.1755 | 13.7898 | 14.2376 | 14.0131 |

| Hurst Index | 0.3025 | 0.3036 | 0.3008 | 0.3052 | 0.3073 | 0.3037 |

| VaR | −0.46% | −0.46% | −0.45% | −0.47% | −0.46% | −0.46% |

| CVaR | −0.71% | −0.72% | −0.70% | −0.73% | −0.73% | −0.72% |

| Sortino Ratio | 1.4990 | 1.5298 | 1.5528 | 1.5171 | 1.5216 | 1.5411 |

| EUR 2000-2020 | ||||||

| Return | 3.12% | 3.18% | 3.13% | 3.19% | 3.20% | 3.18% |

| Standard Deviation | 4.77% | 4.62% | 4.59% | 4.86% | 4.69% | 4.63% |

| Sharpe Ratio | 0.6549 | 0.6892 | 0.6819 | 0.6567 | 0.6832 | 0.6880 |

| Cumulative Return | 87.86% | 90.24% | 88.13% | 90.40% | 90.86% | 90.18% |

| Worst Drawdown | 11.51% | 10.82% | 10.88% | 10.98% | 10.75% | 10.82% |

| Average Drawdown | 1.16% | 1.05% | 1.07% | 1.11% | 1.11% | 1.05% |

| Average Length | 41.2149 | 38.6822 | 39.9120 | 40.9262 | 39.2992 | 38.6822 |

| Average Recovery | 20.6364 | 19.9767 | 20.6880 | 21.7459 | 20.2835 | 19.9767 |

| Hurst Index | 0.3055 | 0.3067 | 0.3059 | 0.3071 | 0.3078 | 0.3068 |

| VaR | −0.46% | −0.45% | −0.45% | −0.47% | −0.45% | −0.45% |

| CVaR | −0.74% | −0.71% | −0.71% | −0.75% | −0.72% | −0.71% |

| Sortino Ratio | 0.9709 | 1.0180 | 1.0070 | 0.9719 | 1.0101 | 1.0164 |

| EUR 2010-2020 | ||||||

| Return | 3.68% | 3.56% | 3.57% | 3.40% | 3.54% | 3.57% |

| Standard Deviation | 4.94% | 4.76% | 4.75% | 4.96% | 4.78% | 4.76% |

| Sharpe Ratio | 0.7444 | 0.7491 | 0.7503 | 0.6857 | 0.7398 | 0.7494 |

| Cumulative Return | 44.91% | 43.28% | 43.29% | 40.97% | 42.90% | 43.30% |

| Worst Drawdown | 11.60% | 10.18% | 10.09% | 10.24% | 10.55% | 10.18% |

| Average Drawdown | 1.12% | 1.21% | 1.20% | 1.08% | 1.16% | 1.21% |

| Average Length | 39.9839 | 41.3833 | 41.3833 | 43.7193 | 39.4921 | 41.3833 |

| Average Recovery | 25.5161 | 27.9667 | 27.9667 | 29.8070 | 26.5556 | 27.9667 |

| Hurst Index | 0.3279 | 0.3289 | 0.3284 | 0.3278 | 0.3292 | 0.3289 |

| VaR | −0.49% | −0.47% | −0.47% | −0.50% | −0.48% | −0.47% |

| CVaR | −0.89% | −0.83% | −0.83% | −0.86% | −0.84% | −0.83% |

| Sortino Ratio | 1.0792 | 1.0867 | 1.0887 | 0.9960 | 1.0727 | 1.0872 |

| Two funds 10/90: Modelli dinamici non vincolati e modello statico 1/N | |||||

|---|---|---|---|---|---|

| Performance delle 12 misure statistiche calcolate sulla base di ciascun modello di ottimizzazione | |||||

| Misura statistica | Modello Statico | Modelli dinamici non vincolati | |||

| 1/N | Boudt SD No-box | HRP | Boudt Random MVP | Boudt Random HS | |

| USD 1985-2020 | |||||

| Return | 8.15% | 7.01% | 6.73% | 6.82% | 8.51% |

| Standard Deviation | 9.71% | 7.54% | 7.43% | 7.50% | 9.94% |

| Sharpe Ratio | 0.8389 | 0.9297 | 0.9064 | 0.9081 | 0.8561 |

| Cumulative Return | 1,572.92% | 1,042.09% | 940.62% | 971.06% | 1,785.92% |

| Worst Drawdown | 26.04% | 19.80% | 20.05% | 20.26% | 23.62% |

| Average Drawdown | 1.18% | 0.96% | 1.04% | 0.99% | 1.38% |

| Average Length | 17.8962 | 18.5793 | 20.7115 | 19.6799 | 19.2255 |

| Average Recovery | 9.2839 | 9.7621 | 11.5623 | 10.8972 | 9.5786 |

| Hurst Index | 0.3720 | 0.3481 | 0.3391 | 0.3461 | 0.3166 |

| VaR | −0.85% | −0.68% | −0.68% | −0.67% | −0.96% |

| CVaR | −1.06% | −1.03% | −1.11% | −0.99% | −1.80% |

| Sortino Ratio | 1.2038 | 1.3536 | 1.3230 | 1.3277 | 1.2441 |

| USD 2000-2020 | |||||

| Return | 5.61% | 3.67% | 3.32% | 3.42% | 3.95% |

| Standard Deviation | 9.73% | 5.92% | 5.91% | 5.89% | 10.55% |

| Sharpe Ratio | 0.5763 | 0.6205 | 0.5615 | 0.5813 | 0.3741 |

| Cumulative Return | 206.22% | 109.50% | 95.41% | 99.48% | 121.19% |

| Worst Drawdown | 27.89% | 18.92% | 19.70% | 19.33% | 41.82% |

| Average Drawdown | 1.07% | 0.60% | 0.70% | 0.65% | 1.53% |

| Average Length | 18.5211 | 18.3409 | 22.0404 | 20.5485 | 31.5190 |

| Average Recovery | 9.5862 | 10.8750 | 13.2466 | 12.4810 | 20.9937 |

| Hurst Index | 0.3735 | 0.3941 | 0.3886 | 0.3929 | 0.3947 |

| VaR | −0.82% | −0.43% | −0.46% | −0.43% | −0.47% |

| CVaR | −0.82% | −0.43% | −0.46% | −0.43% | −0.47% |

| Sortino Ratio | 0.8579 | 0.9024 | 0.8204 | 0.8479 | 0.5834 |

| USD 2010-2020 | |||||

| Return | 8.73% | 5.12% | 4.33% | 4.69% | 5.91% |

| Standard Deviation | 8.61% | 4.29% | 4.03% | 4.03% | 7.57% |

| Sharpe Ratio | 1.0142 | 1.1929 | 1.0750 | 1.1621 | 0.7805 |

| Cumulative Return | 136.12% | 66.96% | 54.52% | 60.06% | 80.30% |

| Worst Drawdown | 19.33% | 9.43% | 8.96% | 9.38% | 17.94% |

| Average Drawdown | 0.80% | 0.43% | 0.47% | 0.43% | 0.83% |

| Average Length | 10.8774 | 12.2158 | 15.0633 | 13.2443 | 13.9763 |

| Average Recovery | 5.4151 | 6.9263 | 8.6329 | 8.0568 | 8.0414 |

| Hurst Index | 0.4136 | 0.4648 | 0.4668 | 0.4719 | 0.3943 |

| VaR | −0.68% | 0.00% | 0.00% | 0.00% | −0.64% |

| CVaR | −0.68% | −0.66% | −0.66% | −0.66% | −0.64% |

| Sortino Ratio | 1.4008 | 1.6077 | 1.4663 | 1.5720 | 1.0945 |

| USD → EUR 1985-2020 | |||||

| Return | 7.12% | 7.20% | 6.74% | 7.09% | 10.18% |

| Standard Deviation | 15.22% | 14.19% | 14.28% | 14.25% | 17.15% |

| Sharpe Ratio | 0.4677 | 0.5076 | 0.4720 | 0.4975 | 0.5936 |

| Cumulative Return | 1,085.41% | 1,120.46% | 943.82% | 1,073.87% | 3,168.48% |

| Worst Drawdown | 46.38% | 48.67% | 46.90% | 49.49% | 41.30% |

| Average Drawdown | 2.85% | 2.85% | 2.86% | 2.96% | 3.00% |

| Average Length | 43.0293 | 42.6893 | 44.8223 | 44.0800 | 30.1419 |

| Average Recovery | 18.6146 | 25.8010 | 25.5990 | 26.0000 | 17.5294 |

| Hurst Index | 0.3254 | 0.2773 | 0.3052 | 0.2760 | 0.3541 |

| VaR | −1.50% | −1.40% | −1.41% | −1.40% | −1.64% |

| CVaR | −2.59% | −2.11% | −2.22% | −2.11% | −3.43% |

| Sortino Ratio | 0.7538 | 0.8078 | 0.7589 | 0.7953 | 0.9212 |

| USD → EUR 2000-2020 | |||||

| Return | 4.14% | 2.89% | 3.00% | 2.68% | 3.35% |

| Standard Deviation | 13.36% | 12.07% | 11.91% | 12.09% | 14.48% |

| Sharpe Ratio | 0.3099 | 0.2396 | 0.2521 | 0.2217 | 0.2315 |

| Cumulative Return | 129.82% | 79.51% | 83.47% | 72.03% | 96.70% |

| Worst Drawdown | 44.67% | 49.70% | 47.02% | 51.00% | 55.46% |

| Average Drawdown | 1.95% | 2.21% | 1.94% | 2.40% | 2.63% |

| Average Length | 47.3738 | 60.6786 | 58.5172 | 67.1579 | 59.3256 |

| Average Recovery | 20.3364 | 38.6667 | 39.8851 | 44.3289 | 28.0465 |

| Hurst Index | 0.3282 | 0.3040 | 0.3117 | 0.3047 | 0.3491 |

| VaR | −1.31% | −1.21% | −1.19% | −1.21% | −1.32% |

| CVaR | −2.15% | −1.87% | −1.82% | −1.86% | −1.80% |

| Sortino Ratio | 0.5236 | 0.4195 | 0.4369 | 0.3953 | 0.4220 |

| USD → EUR 2010-2020 | |||||

| Return | 9.48% | 6.37% | 7.06% | 6.09% | 9.79% |

| Standard Deviation | 11.02% | 8.41% | 8.66% | 8.44% | 11.49% |

| Sharpe Ratio | 0.8604 | 0.7566 | 0.8154 | 0.7217 | 0.8519 |

| Cumulative Return | 153.50% | 88.44% | 101.52% | 83.43% | 160.87% |

| Worst Drawdown | 20.32% | 14.94% | 11.86% | 15.51% | 19.11% |

| Average Drawdown | 1.48% | 1.35% | 1.30% | 1.43% | 1.87% |

| Average Length | 20.1639 | 25.8854 | 24.0485 | 27.9551 | 22.2072 |

| Average Recovery | 10.4754 | 13.4583 | 12.2136 | 14.5618 | 10.5315 |

| Hurst Index | 0.3826 | 0.3763 | 0.3775 | 0.3778 | 0.3371 |

| VaR | −1.01% | −0.77% | −0.80% | −0.76% | −1.13% |

| CVaR | −1.76% | −1.18% | −1.32% | −1.14% | −2.02% |

| Sortino Ratio | 1.2438 | 1.1312 | 1.2056 | 1.0831 | 1.2422 |

| EUR 1985-2020 | |||||

| Return | 6.11% | 6.29% | 6.03% | 5.75% | 6.44% |

| Standard Deviation | 7.29% | 5.14% | 4.84% | 4.72% | 7.87% |

| Sharpe Ratio | 0.8381 | 1.2242 | 1.2474 | 1.2184 | 0.8185 |

| Cumulative Return | 743.31% | 798.04% | 722.17% | 647.65% | 842.89% |

| Worst Drawdown | 28.97% | 24.18% | 19.79% | 20.98% | 31.20% |

| Average Drawdown | 1.44% | 1.16% | 1.07% | 1.03% | 1.99% |

| Average Length | 30.0356 | 30.4928 | 29.6725 | 30.6232 | 43.5590 |

| Average Recovery | 15.4377 | 16.6304 | 14.9789 | 15.5036 | 24.8564 |

| Hurst Index | 0.3340 | 0.2987 | 0.2868 | 0.2881 | 0.2943 |

| VaR | −0.74% | −0.52% | −0.48% | −0.46% | −0.79% |

| CVaR | −1.55% | −0.94% | −0.78% | −0.76% | −1.59% |

| Sortino Ratio | 1.1922 | 1.7462 | 1.8061 | 1.7683 | 1.1651 |

| EUR 2000-2020 | |||||

| Return | 3.22% | 3.41% | 3.14% | 3.00% | 3.38% |

| Standard Deviation | 8.61% | 4.70% | 4.81% | 4.60% | 9.00% |

| Sharpe Ratio | 0.3735 | 0.7254 | 0.6521 | 0.6516 | 0.3752 |

| Cumulative Return | 91.47% | 98.77% | 88.47% | 83.28% | 97.63% |

| Worst Drawdown | 28.95% | 10.64% | 9.79% | 11.50% | 47.26% |

| Average Drawdown | 1.69% | 0.98% | 1.15% | 1.10% | 1.66% |

| Average Length | 38.0152 | 37.2932 | 42.6154 | 45.0090 | 45.6455 |

| Average Recovery | 21.4015 | 21.1353 | 21.4444 | 22.4595 | 22.9273 |

| Hurst Index | 0.3379 | 0.3041 | 0.3062 | 0.3047 | 0.3699 |

| VaR | −0.88% | −0.46% | −0.47% | −0.45% | −0.80% |

| CVaR | −1.74% | −0.72% | −0.73% | −0.70% | −0.94% |

| Sortino Ratio | 0.5720 | 1.0661 | 0.9684 | 0.9640 | 0.5738 |

| EUR 2010-2020 | |||||

| Return | 5.04% | 3.40% | 3.38% | 3.50% | 2.07% |

| Standard Deviation | 9.61% | 4.89% | 4.95% | 4.75% | 8.71% |

| Sharpe Ratio | 0.5245 | 0.6952 | 0.6830 | 0.7363 | 0.2379 |

| Cumulative Return | 65.63% | 40.90% | 40.72% | 42.36% | 23.43% |

| Worst Drawdown | 23.28% | 9.94% | 9.85% | 10.10% | 21.60% |

| Average Drawdown | 1.59% | 1.34% | 1.15% | 1.20% | 2.45% |

| Average Length | 26.5106 | 46.1296 | 47.0943 | 38.9062 | 82.0323 |

| Average Recovery | 13.7766 | 28.6111 | 31.5849 | 24.1875 | 34.3226 |

| Hurst Index | 0.3461 | 0.3241 | 0.3263 | 0.3279 | 0.3168 |

| VaR | −1.00% | −0.49% | −0.49% | −0.47% | −0.90% |

| CVaR | −2.19% | −0.83% | −0.84% | −0.83% | −1.65% |

| Sortino Ratio | 0.7751 | 1.0099 | 0.9961 | 1.0681 | 0.3854 |

Two funds 20/80

| Two funds 20/80: Modelli dinamici vincolati e modello statico standard | ||||||

|---|---|---|---|---|---|---|

| Performance delle 12 misure statistiche calcolate sulla base di ciascun modello di ottimizzazione | ||||||

| Misura statistica | Modello Statico | Modelli dinamici vincolati | ||||

| Standard | Boudt SD ROI | Boudt SD Random | Boudt CVaR ROI | TCOV ROB | Naif | |

| USD 1985-2020 | ||||||

| Return | 6.33% | 6.32% | 6.27% | 6.48% | 6.37% | 6.32% |

| Standard Deviation | 7.90% | 7.70% | 7.65% | 7.73% | 7.73% | 7.69% |

| Sharpe Ratio | 0.8018 | 0.8207 | 0.8191 | 0.8386 | 0.8247 | 0.8221 |

| Cumulative Return | 809.63% | 805.34% | 790.64% | 857.74% | 822.44% | 806.65% |

| Worst Drawdown | 18.44% | 19.04% | 18.97% | 17.91% | 19.02% | 18.99% |

| Average Drawdown | 1.01% | 0.94% | 0.95% | 0.97% | 0.96% | 0.94% |

| Average Length | 19.9671 | 19.5958 | 19.7030 | 18.8731 | 19.4966 | 19.5241 |

| Average Recovery | 10.4272 | 10.4711 | 10.7355 | 9.4009 | 10.7402 | 10.5080 |

| Hurst Index | 0.3457 | 0.3458 | 0.3436 | 0.3445 | 0.3482 | 0.3456 |

| VaR | −0.70% | −0.68% | −0.68% | −0.69% | −0.69% | −0.68% |

| CVaR | −0.95% | −0.93% | −0.95% | −0.99% | −0.96% | −0.93% |

| Sortino Ratio | 1.1884 | 1.2138 | 1.2128 | 1.2387 | 1.2172 | 1.2159 |

| USD 2000-2020 | ||||||

| Return | 3.82% | 3.69% | 3.65% | 3.71% | 3.68% | 3.70% |

| Standard Deviation | 6.24% | 6.00% | 5.96% | 6.13% | 6.06% | 5.99% |

| Sharpe Ratio | 0.6114 | 0.6158 | 0.6117 | 0.6058 | 0.6073 | 0.6169 |

| Cumulative Return | 115.56% | 110.36% | 108.44% | 111.18% | 109.81% | 110.51% |

| Worst Drawdown | 17.93% | 18.43% | 18.39% | 18.08% | 18.58% | 18.42% |

| Average Drawdown | 0.59% | 0.52% | 0.53% | 0.57% | 0.54% | 0.52% |

| Average Length | 18.8249 | 17.8339 | 18.1386 | 17.8235 | 17.9444 | 17.8339 |

| Average Recovery | 11.0039 | 11.2546 | 10.3783 | 11.2353 | 10.2704 | 10.3173 |

| Hurst Index | 0.3953 | 0.3964 | 0.3949 | 0.3987 | 0.3977 | 0.3963 |

| VaR | −0.44% | −0.42% | −0.43% | −0.41% | −0.42% | −0.42% |

| CVaR | −0.44% | −0.42% | −0.43% | −0.41% | −0.42% | −0.42% |

| Sortino Ratio | 0.8906 | 0.8952 | 0.8891 | 0.8837 | 0.8852 | 0.8966 |

| USD 2010-2020 | ||||||

| Return | 5.77% | 5.42% | 5.34% | 5.52% | 5.53% | 5.42% |

| Standard Deviation | 4.57% | 4.27% | 4.23% | 4.39% | 4.32% | 4.27% |

| Sharpe Ratio | 1.2637 | 1.2680 | 1.2629 | 1.2561 | 1.2790 | 1.2681 |

| Cumulative Return | 77.90% | 71.92% | 70.64% | 73.58% | 73.69% | 71.92% |

| Worst Drawdown | 10.92% | 9.94% | 9.89% | 9.94% | 9.94% | 9.94% |

| Average Drawdown | 0.40% | 0.39% | 0.39% | 0.40% | 0.39% | 0.39% |

| Average Length | 10.1982 | 10.2711 | 10.2889 | 10.0696 | 10.0917 | 10.2711 |

| Average Recovery | 5.7401 | 5.8222 | 6.0089 | 5.7478 | 5.7511 | 5.8222 |

| Hurst Index | 0.4675 | 0.4711 | 0.4714 | 0.4676 | 0.4697 | 0.4711 |

| VaR | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| CVaR | −0.66% | −0.66% | −0.66% | −0.66% | −0.66% | −0.66% |

| Sortino Ratio | 1.7216 | 1.7185 | 1.7116 | 1.7127 | 1.7359 | 1.7186 |

| USD → EUR 1985-2020 | ||||||

| Return | 5.32% | 5.42% | 5.41% | 5.54% | 5.39% | 5.35% |

| Standard Deviation | 15.04% | 14.76% | 14.75% | 14.84% | 14.76% | 14.75% |

| Sharpe Ratio | 0.3535 | 0.3669 | 0.3664 | 0.3730 | 0.3653 | 0.3624 |

| Cumulative Return | 544.55% | 566.37% | 564.15% | 594.38% | 561.27% | 550.65% |

| Worst Drawdown | 49.83% | 49.34% | 49.31% | 48.15% | 49.82% | 49.74% |

| Average Drawdown | 3.63% | 3.51% | 3.59% | 3.46% | 3.57% | 3.57% |

| Average Length | 60.5850 | 59.3267 | 60.9658 | 57.7727 | 60.5306 | 60.5442 |

| Average Recovery | 29.8639 | 29.2467 | 30.1233 | 28.4481 | 29.8844 | 29.8844 |

| Hurst Index | 0.2835 | 0.2751 | 0.2758 | 0.2916 | 0.2750 | 0.2751 |

| VaR | −1.45% | −1.42% | −1.42% | −1.43% | −1.42% | −1.42% |

| CVaR | −2.11% | −2.07% | −2.07% | −2.13% | −2.08% | −2.07% |

| Sortino Ratio | 0.6072 | 0.6241 | 0.6232 | 0.6320 | 0.6214 | 0.6177 |

| USD → EUR 2000-2020 | ||||||

| Return | 2.37% | 2.29% | 2.32% | 2.51% | 2.27% | 2.24% |

| Standard Deviation | 12.01% | 11.84% | 11.83% | 11.93% | 11.81% | 11.80% |

| Sharpe Ratio | 0.1976 | 0.1934 | 0.1964 | 0.2100 | 0.1923 | 0.1897 |

| Cumulative Return | 61.78% | 59.11% | 60.14% | 66.14% | 58.48% | 57.47% |

| Worst Drawdown | 49.44% | 49.73% | 49.49% | 49.08% | 49.79% | 49.76% |

| Average Drawdown | 2.54% | 2.71% | 2.68% | 2.50% | 2.69% | 2.61% |

| Average Length | 78.7385 | 83.8852 | 82.5323 | 77.4545 | 85.2167 | 82.5323 |

| Average Recovery | 40.6615 | 43.5082 | 42.5484 | 40.2273 | 44.4667 | 42.8871 |

| Hurst Index | 0.3162 | 0.3125 | 0.3129 | 0.3126 | 0.3128 | 0.3129 |

| VaR | −1.19% | −1.18% | −1.18% | −1.19% | −1.18% | −1.17% |

| CVaR | −1.83% | −1.80% | −1.80% | −1.82% | −1.79% | −1.79% |

| Sortino Ratio | 0.3629 | 0.3558 | 0.3598 | 0.3793 | 0.3539 | 0.3502 |

| USD → EUR 2010-2020 | ||||||

| Return | 6.51% | 6.40% | 6.41% | 6.56% | 6.45% | 6.38% |

| Standard Deviation | 8.89% | 8.59% | 8.60% | 8.77% | 8.63% | 8.60% |

| Sharpe Ratio | 0.7315 | 0.7446 | 0.7447 | 0.7474 | 0.7477 | 0.7424 |

| Cumulative Return | 91.00% | 89.00% | 89.15% | 91.90% | 90.03% | 88.74% |

| Worst Drawdown | 13.90% | 12.88% | 12.82% | 12.78% | 12.69% | 12.78% |

| Average Drawdown | 1.45% | 1.34% | 1.36% | 1.39% | 1.33% | 1.36% |

| Average Length | 28.3409 | 26.7419 | 27.0326 | 28.3750 | 26.5213 | 27.0761 |

| Average Recovery | 17.4091 | 16.3871 | 16.4891 | 17.6250 | 16.2447 | 16.5326 |

| Hurst Index | 0.3831 | 0.3814 | 0.3816 | 0.3800 | 0.3808 | 0.3813 |

| VaR | −0.80% | −0.78% | −0.78% | −0.80% | −0.78% | −0.78% |

| CVaR | −1.20% | −1.17% | −1.17% | −1.24% | −1.20% | −1.17% |

| Sortino Ratio | 1.0926 | 1.1122 | 1.1122 | 1.1156 | 1.1158 | 1.1091 |

| EUR 1985-2020 | ||||||

| Return | 5.33% | 5.41% | 5.39% | 5.35% | 5.42% | 5.46% |

| Standard Deviation | 5.02% | 4.88% | 4.85% | 5.00% | 4.95% | 4.88% |

| Sharpe Ratio | 1.0627 | 1.1079 | 1.1109 | 1.0687 | 1.0936 | 1.1185 |

| Cumulative Return | 547.93% | 564.79% | 559.82% | 550.83% | 567.01% | 577.36% |

| Worst Drawdown | 18.17% | 17.86% | 17.86% | 18.00% | 17.90% | 17.90% |

| Average Drawdown | 1.00% | 0.98% | 0.96% | 1.02% | 0.97% | 0.97% |

| Average Length | 28.9524 | 27.6266 | 27.7068 | 27.9279 | 27.3280 | 27.3183 |

| Average Recovery | 13.4150 | 13.3961 | 12.9088 | 13.3213 | 13.1222 | 13.3473 |

| Hurst Index | 0.3105 | 0.2999 | 0.3011 | 0.3010 | 0.3054 | 0.2998 |

| VaR | −0.49% | −0.47% | −0.47% | −0.49% | −0.48% | −0.47% |

| CVaR | −0.82% | −0.77% | −0.77% | −0.80% | −0.80% | −0.77% |

| Sortino Ratio | 1.5462 | 1.6166 | 1.6216 | 1.5563 | 1.5903 | 1.6303 |

| EUR 2000-2020 | ||||||

| Return | 3.19% | 3.25% | 3.15% | 3.28% | 3.30% | 3.27% |

| Standard Deviation | 5.01% | 4.82% | 4.78% | 4.95% | 4.83% | 4.82% |

| Sharpe Ratio | 0.6364 | 0.6741 | 0.6603 | 0.6629 | 0.6833 | 0.6796 |

| Cumulative Return | 90.44% | 92.66% | 89.09% | 93.90% | 94.77% | 93.64% |

| Worst Drawdown | 14.34% | 12.93% | 12.90% | 12.93% | 12.93% | 12.93% |

| Average Drawdown | 1.15% | 1.10% | 1.08% | 1.14% | 1.10% | 1.09% |

| Average Length | 42.9914 | 39.1260 | 40.4878 | 39.4921 | 38.8359 | 38.5039 |

| Average Recovery | 20.2241 | 21.1339 | 21.0325 | 20.3810 | 20.7891 | 20.8062 |

| Hurst Index | 0.3232 | 0.3148 | 0.3156 | 0.3117 | 0.3145 | 0.3149 |

| VaR | −0.50% | −0.48% | −0.47% | −0.49% | −0.48% | −0.48% |

| CVaR | −0.90% | −0.82% | −0.81% | −0.83% | −0.82% | −0.82% |

| Sortino Ratio | 0.9306 | 0.9873 | 0.9697 | 0.9698 | 0.9992 | 0.9950 |

| EUR 2010-2020 | ||||||

| Return | 4.06% | 3.87% | 3.89% | 3.92% | 3.82% | 3.86% |

| Standard Deviation | 5.44% | 5.16% | 5.09% | 5.33% | 5.18% | 5.16% |

| Sharpe Ratio | 0.7456 | 0.7491 | 0.7634 | 0.7358 | 0.7384 | 0.7485 |

| Cumulative Return | 50.43% | 47.62% | 47.94% | 48.44% | 46.98% | 47.56% |

| Worst Drawdown | 14.51% | 13.07% | 13.04% | 13.07% | 13.07% | 13.07% |

| Average Drawdown | 1.23% | 1.18% | 1.11% | 1.11% | 1.19% | 1.17% |

| Average Length | 38.1846 | 39.3333 | 36.4118 | 38.7500 | 39.4127 | 38.7031 |

| Average Recovery | 18.8923 | 20.0476 | 17.6765 | 27.3125 | 19.9683 | 19.7031 |

| Hurst Index | 0.3429 | 0.3353 | 0.3367 | 0.3312 | 0.3349 | 0.3353 |

| VaR | −0.55% | −0.52% | −0.51% | −0.54% | −0.52% | −0.52% |

| CVaR | −1.14% | −1.00% | −1.00% | −1.01% | −1.00% | −1.00% |

| Sortino Ratio | 1.0706 | 1.0800 | 1.0993 | 1.0629 | 1.0647 | 1.0792 |

| Two funds 20/80: Modelli dinamici non vincolati e modello statico 1/N | |||||

|---|---|---|---|---|---|

| Performance delle 12 misure statistiche calcolate sulla base di ciascun modello di ottimizzazione | |||||

| Misura statistica | Modello Statico | Modelli dinamici non vincolati | |||

| 1/N | Boudt SD No-box | HRP | Boudt Random MVP | Boudt Random HS | |

| USD 1985-2020 | |||||

| Return | 8.15% | 7.01% | 6.73% | 6.82% | 8.51% |

| Standard Deviation | 9.71% | 7.54% | 7.43% | 7.50% | 9.94% |

| Sharpe Ratio | 0.8389 | 0.9297 | 0.9064 | 0.9082 | 0.8561 |

| Cumulative Return | 1,572.92% | 1,042.09% | 940.62% | 971.19% | 1,786.00% |

| Worst Drawdown | 26.04% | 19.80% | 20.05% | 20.26% | 23.62% |

| Average Drawdown | 1.18% | 0.96% | 1.04% | 0.99% | 1.38% |

| Average Length | 17.8962 | 18.5793 | 20.7115 | 19.6340 | 19.2255 |

| Average Recovery | 9.2839 | 9.7621 | 11.5623 | 10.8695 | 9.5786 |

| Hurst Index | 0.3720 | 0.3481 | 0.3391 | 0.3461 | 0.3166 |

| VaR | −0.85% | −0.68% | −0.68% | −0.67% | −0.96% |

| CVaR | −1.06% | −1.03% | −1.11% | −0.99% | −1.80% |

| Sortino Ratio | 1.2038 | 1.3536 | 1.3230 | 1.3278 | 1.2441 |

| USD 2000-2020 | |||||

| Return | 5.61% | 3.67% | 3.32% | 3.42% | 3.95% |

| Standard Deviation | 9.73% | 5.92% | 5.91% | 5.89% | 10.55% |

| Sharpe Ratio | 0.5763 | 0.6205 | 0.5615 | 0.5813 | 0.3741 |

| Cumulative Return | 206.22% | 109.50% | 95.41% | 99.49% | 121.19% |

| Worst Drawdown | 27.89% | 18.92% | 19.70% | 19.32% | 41.82% |

| Average Drawdown | 1.07% | 0.60% | 0.70% | 0.65% | 1.53% |

| Average Length | 18.5211 | 18.3409 | 22.0404 | 20.5485 | 31.5190 |

| Average Recovery | 9.5862 | 10.8750 | 13.2466 | 12.4810 | 20.9937 |

| Hurst Index | 0.3735 | 0.3941 | 0.3886 | 0.3929 | 0.3947 |

| VaR | −0.82% | −0.43% | −0.46% | −0.43% | −0.47% |

| CVaR | −0.82% | −0.43% | −0.46% | −0.43% | −0.47% |

| Sortino Ratio | 0.8579 | 0.9024 | 0.8204 | 0.8479 | 0.5834 |

| USD 2010-2020 | |||||

| Return | 8.73% | 5.12% | 4.33% | 4.69% | 5.91% |

| Standard Deviation | 8.61% | 4.29% | 4.03% | 4.03% | 7.57% |

| Sharpe Ratio | 1.0142 | 1.1929 | 1.0750 | 1.1621 | 0.7804 |

| Cumulative Return | 136.12% | 66.96% | 54.52% | 60.07% | 80.29% |

| Worst Drawdown | 19.33% | 9.43% | 8.96% | 9.38% | 17.94% |

| Average Drawdown | 0.80% | 0.43% | 0.47% | 0.43% | 0.83% |

| Average Length | 10.8774 | 12.2158 | 15.0633 | 13.2443 | 13.9000 |

| Average Recovery | 5.4151 | 6.9263 | 8.6329 | 8.0568 | 8.0706 |

| Hurst Index | 0.4136 | 0.4648 | 0.4668 | 0.4719 | 0.3943 |

| VaR | −0.68% | 0.00% | 0.00% | 0.00% | −0.64% |

| CVaR | −0.68% | −0.66% | −0.66% | −0.66% | −0.64% |

| Sortino Ratio | 1.4008 | 1.6077 | 1.4663 | 1.5719 | 1.0944 |

| USD → EUR 1985-2020 | |||||

| Return | 7.12% | 7.20% | 6.74% | 7.09% | 10.18% |

| Standard Deviation | 15.22% | 14.19% | 14.28% | 14.25% | 17.15% |

| Sharpe Ratio | 0.4677 | 0.5076 | 0.4720 | 0.4975 | 0.5936 |

| Cumulative Return | 1,085.41% | 1,120.46% | 943.82% | 1,073.96% | 3,167.81% |

| Worst Drawdown | 46.38% | 48.67% | 46.90% | 49.49% | 41.30% |

| Average Drawdown | 2.85% | 2.85% | 2.86% | 2.96% | 3.00% |

| Average Length | 43.0293 | 42.6893 | 44.8223 | 44.0800 | 30.1419 |

| Average Recovery | 18.6146 | 25.8010 | 25.5990 | 26.0000 | 17.5294 |

| Hurst Index | 0.3254 | 0.2773 | 0.3052 | 0.2760 | 0.3541 |

| VaR | −1.50% | −1.40% | −1.41% | −1.40% | −1.64% |

| CVaR | −2.59% | −2.11% | −2.22% | −2.11% | −3.43% |

| Sortino Ratio | 0.7538 | 0.8078 | 0.7589 | 0.7953 | 0.9212 |

| USD → EUR 2000-2020 | |||||

| Return | 4.14% | 2.89% | 3.00% | 2.68% | 3.35% |

| Standard Deviation | 13.36% | 12.07% | 11.91% | 12.09% | 14.48% |

| Sharpe Ratio | 0.3099 | 0.2396 | 0.2521 | 0.2218 | 0.2316 |

| Cumulative Return | 129.82% | 79.51% | 83.47% | 72.06% | 96.72% |

| Worst Drawdown | 44.67% | 49.70% | 47.02% | 51.00% | 55.46% |

| Average Drawdown | 1.95% | 2.21% | 1.94% | 2.40% | 2.63% |

| Average Length | 47.3738 | 60.6786 | 58.5172 | 67.1579 | 59.3256 |

| Average Recovery | 20.3364 | 38.6667 | 39.8851 | 44.3289 | 28.0465 |

| Hurst Index | 0.3282 | 0.3040 | 0.3117 | 0.3047 | 0.3491 |

| VaR | −1.31% | −1.21% | −1.19% | −1.21% | −1.32% |

| CVaR | −2.15% | −1.87% | −1.82% | −1.86% | −1.80% |

| Sortino Ratio | 0.5236 | 0.4195 | 0.4369 | 0.3954 | 0.4221 |

| USD → EUR 2010-2020 | |||||

| Return | 9.48% | 6.37% | 7.06% | 6.09% | 9.79% |

| Standard Deviation | 11.02% | 8.41% | 8.66% | 8.44% | 11.49% |

| Sharpe Ratio | 0.8604 | 0.7566 | 0.8154 | 0.7218 | 0.8519 |

| Cumulative Return | 153.50% | 88.44% | 101.52% | 83.44% | 160.87% |

| Worst Drawdown | 20.32% | 14.94% | 11.86% | 15.51% | 19.11% |

| Average Drawdown | 1.48% | 1.35% | 1.30% | 1.43% | 1.87% |

| Average Length | 20.1639 | 25.8854 | 24.0485 | 27.9551 | 22.2072 |

| Average Recovery | 10.4754 | 13.4583 | 12.2136 | 14.5618 | 10.5315 |

| Hurst Index | 0.3826 | 0.3763 | 0.3775 | 0.3778 | 0.3371 |

| VaR | −1.01% | −0.77% | −0.80% | −0.76% | −1.13% |

| CVaR | −1.76% | −1.18% | −1.32% | −1.14% | −2.02% |

| Sortino Ratio | 1.2438 | 1.1312 | 1.2056 | 1.0833 | 1.2423 |

| EUR 1985-2020 | |||||

| Return | 6.11% | 6.29% | 6.03% | 5.75% | 6.44% |

| Standard Deviation | 7.29% | 5.14% | 4.84% | 4.72% | 7.87% |

| Sharpe Ratio | 0.8381 | 1.2242 | 1.2474 | 1.2184 | 0.8185 |

| Cumulative Return | 743.31% | 798.04% | 722.17% | 647.65% | 842.86% |

| Worst Drawdown | 28.97% | 24.18% | 19.79% | 20.98% | 31.20% |

| Average Drawdown | 1.44% | 1.16% | 1.07% | 1.04% | 1.99% |

| Average Length | 30.0356 | 30.4928 | 29.6725 | 30.6232 | 43.5590 |

| Average Recovery | 15.4377 | 16.6304 | 14.9789 | 15.5036 | 24.8564 |

| Hurst Index | 0.3340 | 0.2987 | 0.2868 | 0.2881 | 0.2943 |

| VaR | −0.74% | −0.52% | −0.48% | −0.46% | −0.79% |

| CVaR | −1.55% | −0.94% | −0.78% | −0.76% | −1.59% |

| Sortino Ratio | 1.1922 | 1.7462 | 1.8061 | 1.7683 | 1.1652 |

| EUR 2000-2020 | |||||

| Return | 3.22% | 3.41% | 3.14% | 3.00% | 3.38% |

| Standard Deviation | 8.61% | 4.70% | 4.81% | 4.60% | 9.00% |

| Sharpe Ratio | 0.3735 | 0.7254 | 0.6521 | 0.6515 | 0.3753 |

| Cumulative Return | 91.47% | 98.77% | 88.47% | 83.27% | 97.65% |

| Worst Drawdown | 28.95% | 10.64% | 9.79% | 11.50% | 47.26% |

| Average Drawdown | 1.69% | 0.98% | 1.15% | 1.10% | 1.66% |

| Average Length | 38.0152 | 37.2932 | 42.6154 | 45.0090 | 45.6455 |

| Average Recovery | 21.4015 | 21.1353 | 21.4444 | 22.4595 | 22.9273 |

| Hurst Index | 0.3379 | 0.3041 | 0.3062 | 0.3048 | 0.3699 |

| VaR | −0.88% | −0.46% | −0.47% | −0.45% | −0.80% |

| CVaR | −1.74% | −0.72% | −0.73% | −0.70% | −0.95% |

| Sortino Ratio | 0.5720 | 1.0661 | 0.9684 | 0.9638 | 0.5739 |

| EUR 2010-2020 | |||||

| Return | 5.04% | 3.40% | 3.38% | 3.50% | 2.07% |

| Standard Deviation | 9.61% | 4.89% | 4.95% | 4.75% | 8.71% |

| Sharpe Ratio | 0.5245 | 0.6952 | 0.6830 | 0.7362 | 0.2379 |

| Cumulative Return | 65.63% | 40.90% | 40.72% | 42.35% | 23.43% |

| Worst Drawdown | 23.28% | 9.94% | 9.85% | 10.10% | 21.60% |

| Average Drawdown | 1.59% | 1.34% | 1.15% | 1.20% | 2.45% |

| Average Length | 26.5106 | 46.1296 | 47.0943 | 38.9062 | 82.0323 |

| Average Recovery | 13.7766 | 28.6111 | 31.5849 | 24.1875 | 34.3226 |

| Hurst Index | 0.3461 | 0.3241 | 0.3263 | 0.3279 | 0.3168 |

| VaR | −1.00% | −0.49% | −0.49% | −0.47% | −0.90% |

| CVaR | −2.19% | −0.83% | −0.84% | −0.83% | −1.65% |

| Sortino Ratio | 0.7751 | 1.0099 | 0.9961 | 1.0680 | 0.3855 |

Two funds 30/70

| Two funds 30/70: Modelli dinamici vincolati e modello statico standard | ||||||

|---|---|---|---|---|---|---|

| Performance delle 12 misure statistiche calcolate sulla base di ciascun modello di ottimizzazione | ||||||

| Misura statistica | Modello Statico | Modelli dinamici vincolati | ||||

| Standard | Boudt SD ROI | Boudt SD Random | Boudt CVaR ROI | TCOV ROB | Naif | |

| USD 1985-2020 | ||||||

| Return | 6.96% | 6.84% | 6.85% | 7.09% | 6.94% | 6.86% |

| Standard Deviation | 8.10% | 7.76% | 7.74% | 7.87% | 7.81% | 7.75% |

| Sharpe Ratio | 0.8595 | 0.8814 | 0.8854 | 0.9000 | 0.8890 | 0.8855 |

| Cumulative Return | 1,024.91% | 979.02% | 983.70% | 1,073.19% | 1,017.26% | 988.75% |

| Worst Drawdown | 18.85% | 18.15% | 18.05% | 18.04% | 17.95% | 18.15% |

| Average Drawdown | 1.02% | 0.99% | 0.98% | 1.01% | 0.99% | 0.99% |

| Average Length | 18.3391 | 18.1111 | 17.9915 | 17.5821 | 17.9979 | 18.0340 |

| Average Recovery | 10.1166 | 9.5192 | 9.4713 | 9.0499 | 9.4735 | 9.4553 |

| Hurst Index | 0.3577 | 0.3522 | 0.3520 | 0.3510 | 0.3523 | 0.3523 |

| VaR | −0.71% | −0.68% | −0.68% | −0.70% | −0.69% | −0.68% |

| CVaR | −0.95% | −0.93% | −0.94% | −1.04% | −1.01% | −0.95% |

| Sortino Ratio | 1.2545 | 1.2884 | 1.2942 | 1.3120 | 1.2950 | 1.2931 |

| USD 2000-2020 | ||||||

| Return | 4.44% | 4.28% | 4.24% | 4.33% | 4.37% | 4.28% |

| Standard Deviation | 7.00% | 6.51% | 6.50% | 6.75% | 6.53% | 6.51% |

| Sharpe Ratio | 0.6343 | 0.6576 | 0.6523 | 0.6415 | 0.6693 | 0.6578 |

| Cumulative Return | 143.75% | 136.39% | 134.48% | 138.46% | 140.45% | 136.41% |

| Worst Drawdown | 16.91% | 15.62% | 15.62% | 17.59% | 15.62% | 15.62% |

| Average Drawdown | 0.69% | 0.68% | 0.69% | 0.75% | 0.69% | 0.68% |

| Average Length | 17.3262 | 17.0389 | 17.1099 | 17.2250 | 16.9018 | 17.0424 |

| Average Recovery | 10.6165 | 10.7244 | 10.7482 | 10.5393 | 10.5754 | 10.7279 |

| Hurst Index | 0.3921 | 0.3950 | 0.3946 | 0.3978 | 0.3947 | 0.3950 |

| VaR | −0.51% | −0.46% | −0.46% | −0.45% | −0.47% | −0.46% |

| CVaR | −0.51% | −0.46% | −0.46% | −0.45% | −0.47% | −0.46% |

| Sortino Ratio | 0.9258 | 0.9551 | 0.9480 | 0.9352 | 0.9707 | 0.9553 |

| USD 2010-2020 | ||||||

| Return | 6.77% | 6.36% | 6.25% | 6.44% | 6.43% | 6.36% |

| Standard Deviation | 5.67% | 5.15% | 5.05% | 5.32% | 5.19% | 5.15% |

| Sharpe Ratio | 1.1950 | 1.2344 | 1.2363 | 1.2099 | 1.2391 | 1.2344 |

| Cumulative Return | 95.93% | 88.27% | 86.28% | 89.81% | 89.62% | 88.27% |

| Worst Drawdown | 13.60% | 12.27% | 12.23% | 12.27% | 12.27% | 12.27% |

| Average Drawdown | 0.50% | 0.44% | 0.43% | 0.47% | 0.45% | 0.44% |

| Average Length | 9.9657 | 9.8178 | 9.7764 | 9.9657 | 9.8974 | 9.8178 |

| Average Recovery | 5.6309 | 5.6271 | 5.6034 | 5.7082 | 5.6923 | 5.6271 |

| Hurst Index | 0.4494 | 0.4570 | 0.4585 | 0.4527 | 0.4560 | 0.4570 |

| VaR | −0.17% | −0.05% | −0.02% | −0.12% | −0.07% | −0.05% |

| CVaR | −0.17% | −0.05% | −0.02% | −0.12% | −0.07% | −0.05% |

| Sortino Ratio | 1.6342 | 1.6809 | 1.6877 | 1.6532 | 1.6881 | 1.6809 |

| USD → EUR 1985-2020 | ||||||

| Return | 5.94% | 5.95% | 5.96% | 6.22% | 6.01% | 6.02% |

| Standard Deviation | 14.86% | 14.54% | 14.54% | 14.70% | 14.54% | 14.54% |

| Sharpe Ratio | 0.4000 | 0.4095 | 0.4100 | 0.4232 | 0.4136 | 0.4142 |

| Cumulative Return | 697.10% | 700.51% | 702.64% | 775.88% | 716.36% | 719.02% |

| Worst Drawdown | 47.98% | 47.23% | 47.23% | 45.95% | 47.47% | 47.26% |

| Average Drawdown | 3.19% | 3.18% | 3.18% | 3.16% | 3.19% | 3.19% |

| Average Length | 53.5361 | 51.3237 | 51.3179 | 50.4261 | 51.6163 | 51.6163 |

| Average Recovery | 24.6446 | 24.7746 | 24.7688 | 23.5909 | 24.9186 | 24.9186 |

| Hurst Index | 0.3000 | 0.2929 | 0.2929 | 0.3059 | 0.2929 | 0.2929 |

| VaR | −1.44% | −1.41% | −1.41% | −1.43% | −1.42% | −1.41% |

| CVaR | −2.19% | −2.12% | −2.12% | −2.23% | −2.14% | −2.13% |

| Sortino Ratio | 0.6673 | 0.6790 | 0.6796 | 0.6972 | 0.6837 | 0.6850 |

| USD → EUR 2000-2020 | ||||||

| Return | 2.99% | 3.03% | 2.99% | 3.10% | 2.98% | 3.01% |

| Standard Deviation | 12.13% | 11.84% | 11.84% | 12.06% | 11.86% | 11.85% |

| Sharpe Ratio | 0.2465 | 0.2554 | 0.2523 | 0.2569 | 0.2515 | 0.2540 |

| Cumulative Return | 82.94% | 84.28% | 82.89% | 86.95% | 82.74% | 83.75% |

| Worst Drawdown | 47.25% | 47.12% | 47.12% | 46.68% | 46.99% | 47.12% |

| Average Drawdown | 2.35% | 2.18% | 2.21% | 2.21% | 2.24% | 2.21% |

| Average Length | 67.9867 | 65.2821 | 66.1429 | 62.9383 | 67.0132 | 66.1429 |

| Average Recovery | 33.4533 | 45.0128 | 45.6364 | 30.5926 | 46.2500 | 45.6364 |

| Hurst Index | 0.3235 | 0.3211 | 0.3212 | 0.3200 | 0.3209 | 0.3210 |

| VaR | −1.20% | −1.18% | −1.18% | −1.19% | −1.18% | −1.18% |

| CVaR | −1.89% | −1.84% | −1.83% | −1.86% | −1.84% | −1.84% |

| Sortino Ratio | 0.4303 | 0.4408 | 0.4365 | 0.4446 | 0.4355 | 0.4389 |

| USD → EUR 2010-2020 | ||||||

| Return | 7.51% | 7.34% | 7.29% | 7.55% | 7.44% | 7.37% |

| Standard Deviation | 9.31% | 8.94% | 8.93% | 9.17% | 8.98% | 8.96% |

| Sharpe Ratio | 0.8066 | 0.8207 | 0.8172 | 0.8239 | 0.8289 | 0.8232 |

| Cumulative Return | 110.35% | 106.89% | 106.02% | 111.18% | 108.97% | 107.59% |

| Worst Drawdown | 16.09% | 14.92% | 14.92% | 15.00% | 14.92% | 14.92% |

| Average Drawdown | 1.32% | 1.25% | 1.25% | 1.33% | 1.29% | 1.26% |

| Average Length | 23.5714 | 23.5714 | 23.7981 | 23.8269 | 23.3302 | 23.5619 |

| Average Recovery | 12.9429 | 13.4476 | 13.5962 | 12.6250 | 12.1698 | 13.4381 |

| Hurst Index | 0.3866 | 0.3860 | 0.3863 | 0.3840 | 0.3855 | 0.3858 |

| VaR | −0.84% | −0.80% | −0.80% | −0.83% | −0.81% | −0.81% |

| CVaR | −1.29% | −1.24% | −1.23% | −1.36% | −1.28% | −1.25% |

| Sortino Ratio | 1.1848 | 1.2056 | 1.2009 | 1.2094 | 1.2161 | 1.2090 |

| EUR 1985-2020 | ||||||

| Return | 5.62% | 5.68% | 5.59% | 5.61% | 5.71% | 5.69% |

| Standard Deviation | 5.48% | 5.17% | 5.15% | 5.38% | 5.23% | 5.18% |

| Sharpe Ratio | 1.0258 | 1.0970 | 1.0851 | 1.0418 | 1.0930 | 1.0985 |

| Cumulative Return | 615.37% | 628.05% | 606.33% | 610.91% | 637.11% | 630.95% |

| Worst Drawdown | 17.83% | 17.53% | 17.53% | 17.40% | 17.57% | 17.57% |

| Average Drawdown | 1.06% | 1.01% | 1.03% | 1.08% | 1.01% | 1.01% |

| Average Length | 26.1692 | 25.6636 | 26.5737 | 26.8703 | 26.0708 | 25.6636 |

| Average Recovery | 12.5292 | 12.8364 | 13.3824 | 13.8418 | 13.1631 | 12.8333 |

| Hurst Index | 0.3137 | 0.3082 | 0.3087 | 0.3046 | 0.3078 | 0.3081 |

| VaR | −0.55% | −0.52% | −0.51% | −0.54% | −0.52% | −0.52% |

| CVaR | −1.02% | −0.92% | −0.92% | −0.95% | −0.93% | −0.92% |

| Sortino Ratio | 1.4715 | 1.5773 | 1.5611 | 1.4967 | 1.5690 | 1.5793 |

| EUR 2000-2020 | ||||||

| Return | 3.23% | 3.24% | 3.18% | 3.31% | 3.35% | 3.26% |

| Standard Deviation | 5.86% | 5.36% | 5.34% | 5.60% | 5.41% | 5.36% |

| Sharpe Ratio | 0.5512 | 0.6050 | 0.5962 | 0.5916 | 0.6194 | 0.6080 |

| Cumulative Return | 91.93% | 92.38% | 90.20% | 95.20% | 96.53% | 93.08% |

| Worst Drawdown | 17.18% | 15.75% | 15.67% | 15.99% | 15.75% | 15.75% |

| Average Drawdown | 1.28% | 1.21% | 1.22% | 1.30% | 1.18% | 1.21% |

| Average Length | 35.7286 | 38.6047 | 39.9520 | 37.9618 | 37.3910 | 38.6124 |

| Average Recovery | 17.7500 | 20.2403 | 20.5600 | 18.1985 | 19.4962 | 20.2403 |

| Hurst Index | 0.3279 | 0.3274 | 0.3271 | 0.3221 | 0.3263 | 0.3273 |

| VaR | −0.59% | −0.54% | −0.54% | −0.57% | −0.55% | −0.54% |

| CVaR | −1.15% | −1.02% | −1.02% | −1.05% | −1.03% | −1.02% |

| Sortino Ratio | 0.8069 | 0.8820 | 0.8700 | 0.8617 | 0.9019 | 0.8862 |

| EUR 2010-2020 | ||||||

| Return | 4.41% | 4.18% | 4.20% | 4.12% | 4.15% | 4.18% |

| Standard Deviation | 6.52% | 5.93% | 5.89% | 6.08% | 5.97% | 5.93% |

| Sharpe Ratio | 0.6762 | 0.7049 | 0.7135 | 0.6780 | 0.6940 | 0.7044 |

| Cumulative Return | 55.73% | 52.22% | 52.62% | 51.42% | 51.75% | 52.20% |

| Worst Drawdown | 17.41% | 15.96% | 15.88% | 15.96% | 15.96% | 15.96% |

| Average Drawdown | 1.29% | 1.19% | 1.19% | 1.26% | 1.24% | 1.19% |

| Average Length | 29.2824 | 30.6914 | 30.6543 | 31.4810 | 31.8974 | 30.7037 |

| Average Recovery | 14.3176 | 15.6173 | 15.5802 | 15.8354 | 16.1154 | 15.6296 |

| Hurst Index | 0.3450 | 0.3451 | 0.3452 | 0.3419 | 0.3441 | 0.3451 |

| VaR | −0.67% | −0.61% | −0.60% | −0.63% | −0.61% | −0.61% |

| CVaR | −1.47% | −1.30% | −1.29% | −1.29% | −1.30% | −1.30% |

| Sortino Ratio | 0.9715 | 1.0107 | 1.0229 | 0.9751 | 0.9959 | 1.0101 |

| Two funds 30/70: Modelli dinamici non vincolati e modello statico 1/N | |||||

|---|---|---|---|---|---|

| Performance delle 12 misure statistiche calcolate sulla base di ciascun modello di ottimizzazione | |||||

| Misura statistica | Modello Statico | Modelli dinamici non vincolati | |||

| 1/N | Boudt SD No-box | HRP | Boudt Random MVP | Boudt Random HS | |

| USD 1985-2020 | |||||

| Return | 8.15% | 7.01% | 6.73% | 6.82% | 8.51% |

| Standard Deviation | 9.71% | 7.54% | 7.43% | 7.50% | 9.94% |

| Sharpe Ratio | 0.8389 | 0.9297 | 0.9064 | 0.9082 | 0.8561 |

| Cumulative Return | 1,572.92% | 1,042.09% | 940.62% | 971.19% | 1,786.14% |

| Worst Drawdown | 26.04% | 19.80% | 20.05% | 20.26% | 23.62% |

| Average Drawdown | 1.18% | 0.96% | 1.04% | 0.99% | 1.38% |

| Average Length | 17.8962 | 18.5793 | 20.7115 | 19.6799 | 19.2255 |

| Average Recovery | 9.2839 | 9.7621 | 11.5623 | 10.8972 | 9.5786 |

| Hurst Index | 0.3720 | 0.3481 | 0.3391 | 0.3461 | 0.3166 |

| VaR | −0.85% | −0.68% | −0.68% | −0.67% | −0.96% |

| CVaR | −1.06% | −1.03% | −1.11% | −0.99% | −1.80% |

| Sortino Ratio | 1.2038 | 1.3536 | 1.3230 | 1.3278 | 1.2442 |

| USD 2000-2020 | |||||

| Return | 5.61% | 3.67% | 3.32% | 3.42% | 3.95% |

| Standard Deviation | 9.73% | 5.92% | 5.91% | 5.89% | 10.55% |

| Sharpe Ratio | 0.5763 | 0.6205 | 0.5615 | 0.5813 | 0.3741 |

| Cumulative Return | 206.22% | 109.50% | 95.41% | 99.48% | 121.19% |

| Worst Drawdown | 27.89% | 18.92% | 19.70% | 19.32% | 41.82% |

| Average Drawdown | 1.07% | 0.60% | 0.70% | 0.65% | 1.54% |

| Average Length | 18.5211 | 18.3409 | 22.0404 | 20.5527 | 31.7197 |

| Average Recovery | 9.5862 | 10.8750 | 13.2466 | 12.4852 | 21.1210 |

| Hurst Index | 0.3735 | 0.3941 | 0.3886 | 0.3929 | 0.3947 |

| VaR | −0.82% | −0.43% | −0.46% | −0.43% | −0.47% |

| CVaR | −0.82% | −0.43% | −0.46% | −0.43% | −0.47% |

| Sortino Ratio | 0.8579 | 0.9024 | 0.8204 | 0.8479 | 0.5834 |

| USD 2010-2020 | |||||

| Return | 8.73% | 5.12% | 4.33% | 4.69% | 5.91% |

| Standard Deviation | 8.61% | 4.29% | 4.03% | 4.03% | 7.57% |

| Sharpe Ratio | 1.0142 | 1.1929 | 1.0750 | 1.1620 | 0.7804 |

| Cumulative Return | 136.12% | 66.96% | 54.52% | 60.06% | 80.29% |

| Worst Drawdown | 19.33% | 9.43% | 8.96% | 9.38% | 17.94% |

| Average Drawdown | 0.80% | 0.43% | 0.47% | 0.43% | 0.83% |

| Average Length | 10.8774 | 12.2158 | 15.0633 | 13.2443 | 13.9763 |

| Average Recovery | 5.4151 | 6.9263 | 8.6329 | 8.0568 | 8.0414 |

| Hurst Index | 0.4136 | 0.4648 | 0.4668 | 0.4719 | 0.3943 |

| VaR | −0.68% | 0.00% | 0.00% | 0.00% | −0.64% |

| CVaR | −0.68% | −0.22% | −0.22% | −0.22% | −0.64% |

| Sortino Ratio | 1.4008 | 1.6077 | 1.4663 | 1.5718 | 1.0945 |

| USD → EUR 1985-2020 | |||||

| Return | 7.12% | 7.20% | 6.74% | 7.09% | 10.18% |

| Standard Deviation | 15.22% | 14.19% | 14.28% | 14.25% | 17.15% |

| Sharpe Ratio | 0.4677 | 0.5076 | 0.4720 | 0.4975 | 0.5936 |

| Cumulative Return | 1,085.41% | 1,120.46% | 943.82% | 1,073.72% | 3,168.75% |

| Worst Drawdown | 46.38% | 48.67% | 46.90% | 49.49% | 41.30% |

| Average Drawdown | 2.85% | 2.85% | 2.86% | 2.96% | 3.00% |

| Average Length | 43.0293 | 42.6893 | 44.8223 | 44.0800 | 30.1419 |

| Average Recovery | 18.6146 | 25.8010 | 25.5990 | 26.0000 | 17.5294 |

| Hurst Index | 0.3254 | 0.2773 | 0.3052 | 0.2760 | 0.3541 |

| VaR | −1.50% | −1.40% | −1.41% | −1.40% | −1.64% |

| CVaR | −2.59% | −2.11% | −2.22% | −2.11% | −3.43% |

| Sortino Ratio | 0.7538 | 0.8078 | 0.7589 | 0.7952 | 0.9212 |

| USD → EUR 2000-2020 | |||||

| Return | 4.14% | 2.89% | 3.00% | 2.68% | 3.35% |

| Standard Deviation | 13.36% | 12.07% | 11.91% | 12.09% | 14.48% |

| Sharpe Ratio | 0.3099 | 0.2396 | 0.2521 | 0.2217 | 0.2315 |

| Cumulative Return | 129.82% | 79.51% | 83.47% | 72.03% | 96.70% |

| Worst Drawdown | 44.67% | 49.70% | 47.02% | 51.00% | 55.46% |

| Average Drawdown | 1.95% | 2.21% | 1.94% | 2.40% | 2.63% |

| Average Length | 47.3738 | 60.6786 | 58.5172 | 67.1579 | 59.3256 |

| Average Recovery | 20.3364 | 38.6667 | 39.8851 | 44.3289 | 28.0465 |

| Hurst Index | 0.3282 | 0.3040 | 0.3117 | 0.3047 | 0.3491 |

| VaR | −1.31% | −1.21% | −1.19% | −1.21% | −1.32% |

| CVaR | −2.15% | −1.87% | −1.82% | −1.86% | −1.80% |

| Sortino Ratio | 0.5236 | 0.4195 | 0.4369 | 0.3953 | 0.4220 |

| USD → EUR 2010-2020 | |||||

| Return | 9.48% | 6.37% | 7.06% | 6.09% | 9.79% |

| Standard Deviation | 11.02% | 8.41% | 8.66% | 8.44% | 11.49% |

| Sharpe Ratio | 0.8604 | 0.7566 | 0.8154 | 0.7217 | 0.8519 |

| Cumulative Return | 153.50% | 88.44% | 101.52% | 83.43% | 160.88% |

| Worst Drawdown | 20.32% | 14.94% | 11.86% | 15.51% | 19.11% |

| Average Drawdown | 1.48% | 1.35% | 1.30% | 1.43% | 1.87% |

| Average Length | 20.1639 | 25.8854 | 24.0485 | 27.9551 | 22.2072 |

| Average Recovery | 10.4754 | 13.4583 | 12.2136 | 14.5618 | 10.5315 |

| Hurst Index | 0.3826 | 0.3763 | 0.3775 | 0.3778 | 0.3371 |

| VaR | −1.01% | −0.77% | −0.80% | −0.76% | −1.13% |

| CVaR | −1.76% | −1.18% | −1.32% | −1.14% | −2.02% |

| Sortino Ratio | 1.2438 | 1.1312 | 1.2056 | 1.0831 | 1.2422 |

| EUR 1985-2020 | |||||

| Return | 6.11% | 6.29% | 6.03% | 5.75% | 6.44% |

| Standard Deviation | 7.29% | 5.14% | 4.84% | 4.72% | 7.87% |

| Sharpe Ratio | 0.8381 | 1.2242 | 1.2474 | 1.2184 | 0.8185 |

| Cumulative Return | 743.31% | 798.04% | 722.17% | 647.67% | 842.85% |

| Worst Drawdown | 28.97% | 24.18% | 19.79% | 20.98% | 31.20% |

| Average Drawdown | 1.44% | 1.16% | 1.07% | 1.04% | 1.99% |

| Average Length | 30.0356 | 30.4928 | 29.6725 | 30.6232 | 43.5590 |

| Average Recovery | 15.4377 | 16.6304 | 14.9789 | 15.5036 | 24.8564 |

| Hurst Index | 0.3340 | 0.2987 | 0.2868 | 0.2881 | 0.2943 |

| VaR | −0.74% | −0.52% | −0.48% | −0.46% | −0.79% |

| CVaR | −1.55% | −0.94% | −0.78% | −0.76% | −1.59% |

| Sortino Ratio | 1.1922 | 1.7462 | 1.8061 | 1.7683 | 1.1652 |

| EUR 2000-2020 | |||||

| Return | 3.22% | 3.41% | 3.14% | 3.00% | 3.38% |

| Standard Deviation | 8.61% | 4.70% | 4.81% | 4.60% | 9.00% |

| Sharpe Ratio | 0.3735 | 0.7254 | 0.6521 | 0.6515 | 0.3753 |

| Cumulative Return | 91.47% | 98.77% | 88.47% | 83.27% | 97.64% |

| Worst Drawdown | 28.95% | 10.64% | 9.79% | 11.50% | 47.26% |

| Average Drawdown | 1.69% | 0.98% | 1.15% | 1.10% | 1.66% |

| Average Length | 38.0152 | 37.2932 | 42.6154 | 45.0090 | 45.6455 |

| Average Recovery | 21.4015 | 21.1353 | 21.4444 | 22.4595 | 22.9273 |

| Hurst Index | 0.3379 | 0.3041 | 0.3062 | 0.3048 | 0.3699 |

| VaR | −0.88% | −0.46% | −0.47% | −0.45% | −0.80% |

| CVaR | −1.74% | −0.72% | −0.73% | −0.70% | −0.95% |

| Sortino Ratio | 0.5720 | 1.0661 | 0.9684 | 0.9638 | 0.5739 |

| EUR 2010-2020 | |||||

| Return | 5.04% | 3.40% | 3.38% | 3.50% | 2.07% |

| Standard Deviation | 9.61% | 4.89% | 4.95% | 4.75% | 8.71% |

| Sharpe Ratio | 0.5245 | 0.6952 | 0.6830 | 0.7362 | 0.2379 |

| Cumulative Return | 65.63% | 40.90% | 40.72% | 42.35% | 23.43% |

| Worst Drawdown | 23.28% | 9.94% | 9.85% | 10.10% | 21.60% |

| Average Drawdown | 1.59% | 1.34% | 1.15% | 1.20% | 2.45% |

| Average Length | 26.5106 | 46.1296 | 47.0943 | 38.9062 | 82.0323 |

| Average Recovery | 13.7766 | 28.6111 | 31.5849 | 24.1875 | 34.3226 |

| Hurst Index | 0.3461 | 0.3241 | 0.3263 | 0.3279 | 0.3168 |

| VaR | −1.00% | −0.49% | −0.49% | −0.47% | −0.90% |

| CVaR | −2.19% | −0.83% | −0.84% | −0.83% | −1.65% |

| Sortino Ratio | 0.7751 | 1.0099 | 0.9961 | 1.0679 | 0.3854 |

Two funds 40/60

| Two funds 40/60: Modelli dinamici vincolati e modello statico standard | ||||||

|---|---|---|---|---|---|---|

| Performance delle 12 misure statistiche calcolate sulla base di ciascun modello di ottimizzazione | ||||||

| Misura statistica | Modello Statico | Modelli dinamici vincolati | ||||

| Standard | Boudt SD ROI | Boudt SD Random | Boudt CVaR ROI | TCOV ROB | Naif | |

| USD 1985-2020 | ||||||

| Return | 7.57% | 7.47% | 7.48% | 7.68% | 7.46% | 7.47% |

| Standard Deviation | 8.73% | 8.27% | 8.27% | 8.45% | 8.29% | 8.27% |

| Sharpe Ratio | 0.8670 | 0.9038 | 0.9036 | 0.9089 | 0.8998 | 0.9033 |

| Cumulative Return | 1,278.27% | 1,234.18% | 1,236.79% | 1,330.59% | 1,228.38% | 1,232.96% |

| Worst Drawdown | 20.88% | 19.73% | 19.67% | 20.41% | 19.73% | 19.73% |

| Average Drawdown | 1.10% | 1.04% | 1.04% | 1.08% | 1.04% | 1.04% |

| Average Length | 18.1156 | 17.4773 | 17.4876 | 17.4421 | 17.5373 | 17.3992 |

| Average Recovery | 9.3640 | 9.3512 | 9.3905 | 9.2686 | 9.2739 | 9.3066 |

| Hurst Index | 0.3681 | 0.3652 | 0.3654 | 0.3628 | 0.3649 | 0.3652 |

| VaR | −0.76% | −0.72% | −0.72% | −0.75% | −0.73% | −0.72% |

| CVaR | −0.97% | −0.93% | −0.92% | −1.14% | −0.95% | −0.93% |

| Sortino Ratio | 1.2505 | 1.3040 | 1.3035 | 1.3093 | 1.2986 | 1.3034 |

| USD 2000-2020 | ||||||

| Return | 5.04% | 4.82% | 4.81% | 4.86% | 4.87% | 4.82% |

| Standard Deviation | 8.21% | 7.56% | 7.57% | 7.82% | 7.58% | 7.56% |

| Sharpe Ratio | 0.6133 | 0.6378 | 0.6360 | 0.6217 | 0.6419 | 0.6380 |

| Cumulative Return | 174.01% | 162.68% | 162.36% | 164.80% | 165.01% | 162.76% |

| Worst Drawdown | 21.50% | 18.72% | 18.83% | 21.62% | 18.72% | 18.72% |

| Average Drawdown | 0.86% | 0.81% | 0.81% | 0.85% | 0.81% | 0.81% |

| Average Length | 17.4928 | 17.7316 | 17.6667 | 18.5287 | 17.6593 | 17.7279 |

| Average Recovery | 9.3152 | 9.6581 | 9.6813 | 10.0766 | 9.6374 | 9.6397 |

| Hurst Index | 0.3835 | 0.3877 | 0.3878 | 0.3907 | 0.3874 | 0.3877 |

| VaR | −0.65% | −0.58% | −0.58% | −0.58% | −0.58% | −0.58% |

| CVaR | −0.65% | −0.58% | −0.58% | −0.58% | −0.58% | −0.58% |

| Sortino Ratio | 0.9018 | 0.9323 | 0.9302 | 0.9114 | 0.9377 | 0.9326 |

| USD 2010-2020 | ||||||

| Return | 7.76% | 7.31% | 7.27% | 7.43% | 7.35% | 7.31% |

| Standard Deviation | 7.06% | 6.39% | 6.36% | 6.64% | 6.43% | 6.39% |

| Sharpe Ratio | 1.0990 | 1.1441 | 1.1418 | 1.1202 | 1.1431 | 1.1441 |

| Cumulative Return | 115.31% | 106.29% | 105.49% | 108.77% | 107.13% | 106.23% |

| Worst Drawdown | 16.34% | 14.91% | 14.97% | 14.91% | 14.91% | 14.91% |

| Average Drawdown | 0.64% | 0.57% | 0.57% | 0.63% | 0.58% | 0.57% |

| Average Length | 10.1674 | 10.0870 | 10.1310 | 10.4661 | 10.0913 | 10.0870 |

| Average Recovery | 5.4317 | 5.3826 | 5.4192 | 5.6380 | 5.3783 | 5.3826 |

| Hurst Index | 0.4304 | 0.4387 | 0.4395 | 0.4338 | 0.4378 | 0.4387 |

| VaR | −0.44% | −0.33% | −0.31% | −0.40% | −0.34% | −0.33% |

| CVaR | −0.44% | −0.33% | −0.31% | −0.40% | −0.34% | −0.33% |

| Sortino Ratio | 1.5089 | 1.5656 | 1.5643 | 1.5355 | 1.5631 | 1.5657 |

| USD → EUR 1985-2020 | ||||||

| Return | 6.54% | 6.50% | 6.50% | 6.81% | 6.61% | 6.51% |

| Standard Deviation | 14.91% | 14.56% | 14.57% | 14.77% | 14.57% | 14.55% |

| Sharpe Ratio | 0.4387 | 0.4464 | 0.4462 | 0.4614 | 0.4539 | 0.4472 |

| Cumulative Return | 876.63% | 862.88% | 863.10% | 970.80% | 900.58% | 865.87% |

| Worst Drawdown | 46.89% | 45.86% | 45.86% | 44.63% | 45.86% | 45.86% |

| Average Drawdown | 2.88% | 2.87% | 2.88% | 2.78% | 2.81% | 2.86% |

| Average Length | 45.4103 | 46.3455 | 46.5947 | 43.3627 | 45.3641 | 46.1094 |

| Average Recovery | 20.3795 | 20.9424 | 21.0632 | 19.5392 | 20.4205 | 20.8229 |

| Hurst Index | 0.3147 | 0.3094 | 0.3099 | 0.3196 | 0.3093 | 0.3094 |

| VaR | −1.46% | −1.43% | −1.43% | −1.45% | −1.43% | −1.43% |

| CVaR | −2.35% | −2.25% | −2.26% | −2.41% | −2.28% | −2.25% |

| Sortino Ratio | 0.7169 | 0.7263 | 0.7260 | 0.7458 | 0.7354 | 0.7272 |

| USD → EUR 2000-2020 | ||||||

| Return | 3.58% | 3.51% | 3.52% | 3.61% | 3.59% | 3.50% |

| Standard Deviation | 12.58% | 12.19% | 12.21% | 12.43% | 12.20% | 12.19% |

| Sharpe Ratio | 0.2843 | 0.2882 | 0.2882 | 0.2904 | 0.2945 | 0.2874 |

| Cumulative Return | 105.65% | 103.01% | 103.23% | 106.92% | 106.23% | 102.62% |

| Worst Drawdown | 45.30% | 44.89% | 44.82% | 45.37% | 44.89% | 44.89% |

| Average Drawdown | 1.91% | 1.87% | 1.88% | 1.91% | 1.86% | 1.89% |

| Average Length | 50.8600 | 51.8673 | 51.8776 | 50.8400 | 51.3232 | 52.4124 |

| Average Recovery | 24.3800 | 34.2755 | 34.2551 | 24.2900 | 33.8990 | 34.6701 |

| Hurst Index | 0.3273 | 0.3261 | 0.3262 | 0.3247 | 0.3260 | 0.3261 |

| VaR | −1.24% | −1.21% | −1.21% | −1.23% | −1.21% | −1.21% |

| CVaR | −2.00% | −1.92% | −1.93% | −1.95% | −1.92% | −1.92% |

| Sortino Ratio | 0.4844 | 0.4874 | 0.4875 | 0.4920 | 0.4961 | 0.4863 |

| USD → EUR 2010-2020 | ||||||

| Return | 8.50% | 8.23% | 8.22% | 8.57% | 8.27% | 8.20% |

| Standard Deviation | 10.04% | 9.60% | 9.62% | 9.88% | 9.62% | 9.59% |

| Sharpe Ratio | 0.8469 | 0.8580 | 0.8543 | 0.8675 | 0.8598 | 0.8545 |

| Cumulative Return | 131.16% | 125.31% | 124.91% | 132.63% | 126.12% | 124.53% |

| Worst Drawdown | 18.24% | 17.09% | 17.15% | 17.17% | 17.09% | 17.09% |

| Average Drawdown | 1.32% | 1.29% | 1.28% | 1.35% | 1.32% | 1.29% |

| Average Length | 20.9153 | 21.4435 | 21.2586 | 20.5833 | 21.1197 | 21.4435 |

| Average Recovery | 10.8644 | 11.2348 | 11.1552 | 10.4917 | 10.9658 | 11.0609 |

| Hurst Index | 0.3860 | 0.3863 | 0.3864 | 0.3836 | 0.3859 | 0.3863 |

| VaR | −0.91% | −0.87% | −0.87% | −0.91% | −0.87% | −0.87% |

| CVaR | −1.49% | −1.40% | −1.40% | −1.57% | −1.43% | −1.40% |

| Sortino Ratio | 1.2307 | 1.2493 | 1.2441 | 1.2601 | 1.2500 | 1.2440 |

| EUR 1985-2020 | ||||||

| Return | 5.88% | 5.89% | 5.78% | 5.94% | 5.98% | 5.91% |

| Standard Deviation | 6.27% | 5.83% | 5.82% | 6.02% | 5.85% | 5.83% |

| Sharpe Ratio | 0.9387 | 1.0105 | 0.9942 | 0.9867 | 1.0217 | 1.0129 |

| Cumulative Return | 681.10% | 682.29% | 655.74% | 697.11% | 707.40% | 687.46% |

| Worst Drawdown | 23.02% | 20.24% | 20.35% | 20.72% | 20.24% | 20.24% |

| Average Drawdown | 1.23% | 1.15% | 1.15% | 1.20% | 1.15% | 1.16% |

| Average Length | 26.8952 | 26.6038 | 26.6877 | 26.9809 | 26.5110 | 26.9331 |

| Average Recovery | 13.1841 | 13.1635 | 13.1735 | 13.2994 | 13.1191 | 13.3471 |

| Hurst Index | 0.3252 | 0.3184 | 0.3191 | 0.3148 | 0.3179 | 0.3183 |

| VaR | −0.63% | −0.59% | −0.59% | −0.61% | −0.59% | −0.59% |

| CVaR | −1.27% | −1.15% | −1.15% | −1.17% | −1.16% | −1.15% |

| Sortino Ratio | 1.3363 | 1.4379 | 1.4158 | 1.4030 | 1.4530 | 1.4412 |

| EUR 2000-2020 | ||||||

| Return | 3.24% | 3.21% | 3.21% | 3.25% | 3.31% | 3.21% |

| Standard Deviation | 7.11% | 6.43% | 6.45% | 6.73% | 6.46% | 6.43% |

| Sharpe Ratio | 0.4553 | 0.4987 | 0.4966 | 0.4837 | 0.5129 | 0.4987 |

| Cumulative Return | 92.28% | 91.05% | 91.00% | 92.83% | 95.18% | 91.05% |

| Worst Drawdown | 22.06% | 19.34% | 19.44% | 22.64% | 19.34% | 19.34% |

| Average Drawdown | 1.54% | 1.42% | 1.44% | 1.46% | 1.41% | 1.42% |

| Average Length | 35.9784 | 35.1831 | 35.4397 | 35.7000 | 34.4207 | 35.1831 |

| Average Recovery | 18.0935 | 17.6268 | 17.7447 | 18.1929 | 17.2000 | 17.6268 |

| Hurst Index | 0.3335 | 0.3298 | 0.3298 | 0.3244 | 0.3292 | 0.3298 |

| VaR | −0.73% | −0.66% | −0.66% | −0.69% | −0.66% | −0.66% |

| CVaR | −1.44% | −1.29% | −1.29% | −1.32% | −1.29% | −1.29% |

| Sortino Ratio | 0.6774 | 0.7348 | 0.7321 | 0.7143 | 0.7542 | 0.7348 |

| EUR 2010-2020 | ||||||

| Return | 4.74% | 4.55% | 4.56% | 4.46% | 4.51% | 4.55% |

| Standard Deviation | 7.96% | 7.19% | 7.22% | 7.38% | 7.24% | 7.19% |

| Sharpe Ratio | 0.5951 | 0.6328 | 0.6316 | 0.6045 | 0.6230 | 0.6328 |

| Cumulative Return | 60.81% | 57.90% | 58.01% | 56.55% | 57.29% | 57.90% |

| Worst Drawdown | 20.26% | 18.84% | 18.82% | 18.84% | 18.84% | 18.84% |

| Average Drawdown | 1.42% | 1.38% | 1.38% | 1.45% | 1.38% | 1.38% |

| Average Length | 26.1895 | 28.8953 | 28.8953 | 29.3412 | 28.9186 | 28.8953 |

| Average Recovery | 12.8105 | 14.5116 | 14.5116 | 14.7294 | 14.5349 | 14.5116 |

| Hurst Index | 0.3413 | 0.3438 | 0.3431 | 0.3404 | 0.3429 | 0.3438 |

| VaR | −0.83% | −0.75% | −0.75% | −0.77% | −0.75% | −0.75% |

| CVaR | −1.82% | −1.64% | −1.65% | −1.64% | −1.64% | −1.64% |

| Sortino Ratio | 0.8640 | 0.9130 | 0.9114 | 0.8756 | 0.8994 | 0.9130 |

| Two funds 40/60: Modelli dinamici non vincolati e modello statico 1/N | |||||

|---|---|---|---|---|---|

| Performance delle 12 misure statistiche calcolate sulla base di ciascun modello di ottimizzazione | |||||

| Misura statistica | Modello Statico | Modelli dinamici non vincolati | |||

| 1/N | Boudt SD No-box | HRP | Boudt Random MVP | Boudt Random HS | |

| USD 1985-2020 | |||||

| Return | 8.15% | 7.01% | 6.73% | 6.82% | 8.51% |

| Standard Deviation | 9.71% | 7.54% | 7.43% | 7.50% | 9.94% |

| Sharpe Ratio | 0.8389 | 0.9297 | 0.9064 | 0.9082 | 0.8561 |

| Cumulative Return | 1,572.92% | 1,042.09% | 940.62% | 971.19% | 1,786.00% |

| Worst Drawdown | 26.04% | 19.80% | 20.05% | 20.26% | 23.62% |

| Average Drawdown | 1.18% | 0.96% | 1.04% | 0.99% | 1.38% |

| Average Length | 17.8962 | 18.5793 | 20.7115 | 19.6340 | 19.2255 |

| Average Recovery | 9.2839 | 9.7621 | 11.5623 | 10.8695 | 9.5786 |

| Hurst Index | 0.3720 | 0.3481 | 0.3391 | 0.3461 | 0.3166 |

| VaR | −0.85% | −0.68% | −0.68% | −0.67% | −0.96% |

| CVaR | −1.06% | −1.03% | −1.11% | −0.99% | −1.80% |

| Sortino Ratio | 1.2038 | 1.3536 | 1.3230 | 1.3278 | 1.2441 |

| USD 2000-2020 | |||||

| Return | 5.61% | 3.67% | 3.32% | 3.42% | 3.95% |

| Standard Deviation | 9.73% | 5.92% | 5.91% | 5.89% | 10.55% |

| Sharpe Ratio | 0.5763 | 0.6205 | 0.5615 | 0.5813 | 0.3741 |

| Cumulative Return | 206.22% | 109.50% | 95.41% | 99.49% | 121.19% |

| Worst Drawdown | 27.89% | 18.92% | 19.70% | 19.32% | 41.82% |

| Average Drawdown | 1.07% | 0.60% | 0.70% | 0.65% | 1.53% |

| Average Length | 18.5211 | 18.3409 | 22.0404 | 20.5485 | 31.5190 |

| Average Recovery | 9.5862 | 10.8750 | 13.2466 | 12.4810 | 20.9937 |

| Hurst Index | 0.3735 | 0.3941 | 0.3886 | 0.3929 | 0.3947 |

| VaR | −0.82% | −0.43% | −0.46% | −0.43% | −0.47% |

| CVaR | −0.82% | −0.43% | −0.46% | −0.43% | −0.47% |

| Sortino Ratio | 0.8579 | 0.9024 | 0.8204 | 0.8479 | 0.5834 |

| USD 2010-2020 | |||||

| Return | 8.73% | 5.12% | 4.33% | 4.69% | 5.91% |

| Standard Deviation | 8.61% | 4.29% | 4.03% | 4.03% | 7.57% |

| Sharpe Ratio | 1.0142 | 1.1929 | 1.0750 | 1.1621 | 0.7804 |

| Cumulative Return | 136.12% | 66.96% | 54.52% | 60.07% | 80.29% |

| Worst Drawdown | 19.33% | 9.43% | 8.96% | 9.38% | 17.94% |

| Average Drawdown | 0.80% | 0.43% | 0.47% | 0.43% | 0.83% |

| Average Length | 10.8774 | 12.2158 | 15.0633 | 13.2443 | 13.9000 |

| Average Recovery | 5.4151 | 6.9263 | 8.6329 | 8.0568 | 8.0706 |

| Hurst Index | 0.4136 | 0.4648 | 0.4668 | 0.4719 | 0.3943 |

| VaR | −0.68% | 0.00% | 0.00% | 0.00% | −0.64% |

| CVaR | −0.68% | −0.43% | −0.43% | −0.43% | −0.64% |

| Sortino Ratio | 1.4008 | 1.6077 | 1.4663 | 1.5719 | 1.0944 |

| USD → EUR 1985-2020 | |||||

| Return | 7.12% | 7.20% | 6.74% | 7.09% | 10.18% |

| Standard Deviation | 15.22% | 14.19% | 14.28% | 14.25% | 17.15% |